July 2009

Market Equilibrium a result of “Uncertainty and the Squeeze”

as seen online: REJournals.com

As we all know and have heard on a daily basis for the past 12 to 18 months, our local and global economies have slowed, lending institutions have been pushed to the brink, and as a result, real estate markets have drastically changed.

As we all know and have heard on a daily basis for the past 12 to 18 months, our local and global economies have slowed, lending institutions have been pushed to the brink, and as a result, real estate markets have drastically changed.

But what does that really mean?

Arguably, only a select few industry veterans can speak of living through an era that was subjected to such rapid and significant market disruptions and deterioration. Many questions remain. What do we know for sure? Lending has tightened, cap rates have risen, property values have eroded, credit of every individual and company is in question, cash reserves and credit lines have dwindled, capital deployment in new projects and even for improvements in quality assets is a challenge to obtain, conservatism (and cash) is king, and value is sought after and found through savings and efficiency. The uncertainty and fear prevailing in the market and broader economy has seemed to create a temporary paralysis across geographical markets and industry sectors. Brokers, developers, contractors, investors, tenants, and users alike are all feeling the resulting squeeze – like a crowded elevator, no one is comfortable.

So when will we return to “business as usual?”

Business as Usual vs. The New Normal

The environment we find ourselves in currently is the new business as usual. Our markets have been irreversibly changed, but the good news is that they will continue to evolve. Real estate deals that will occur, and have occurred in the most recent past, are the most basic and most fundamental. We have witnessed values and margins compress and markets deleverage, we have almost gone back in time. This throwback market requires throwback type deals. These are fundamental deal structures that adequately represent the balance of risk and reward and representative of capital that is available.

Landlords and Developers

Both private owners and institutional landlords have reevaluated their asset plans and budget strategies. This has occurred not by choice but out of necessity and is in reaction to market forces. A common response recently following issuance of RFP’s has been “we will not lose a deal on price.” Tenants in the market are well aware of this, and as a result are using all means to reap the benefits. Asking prices have come down in response to the increased competition for the reduced volume of deal flow. Crucial elements which tend to surface in many discussions and negotiations from our landlord clients’ perspective include: preservation of their capital, the desire for increased elements of certainty to mitigate risk, retaining and securing credit worthy tenants, and securitizing any additional investment or improvements required.

Tenants

There are three key elements of tenant requirements that appear to be constants in today’s market. Tenants are seeking means to improve cash flow, create and/or maintain flexibility, and reevaluating previous real estate strategy. Successfully representing a tenant in the current market will achieve all three of the objectives listed above. The current market is presenting opportunities for companies who are in position to take advantage of it and are not afraid to make a move. More conservative companies have questioned their ability and the cost to downsize. To take that a step further, we have facilitated our more aggressive clients’ searches for alterative locations that may be equivalent in size at a reduced price per square foot (This is a bit unclear). Some have even explored taking advantage of the market by locating to larger spaces with similar gross annual obligation to grow their business or perhaps even sublease the additional space to create additional revenues.

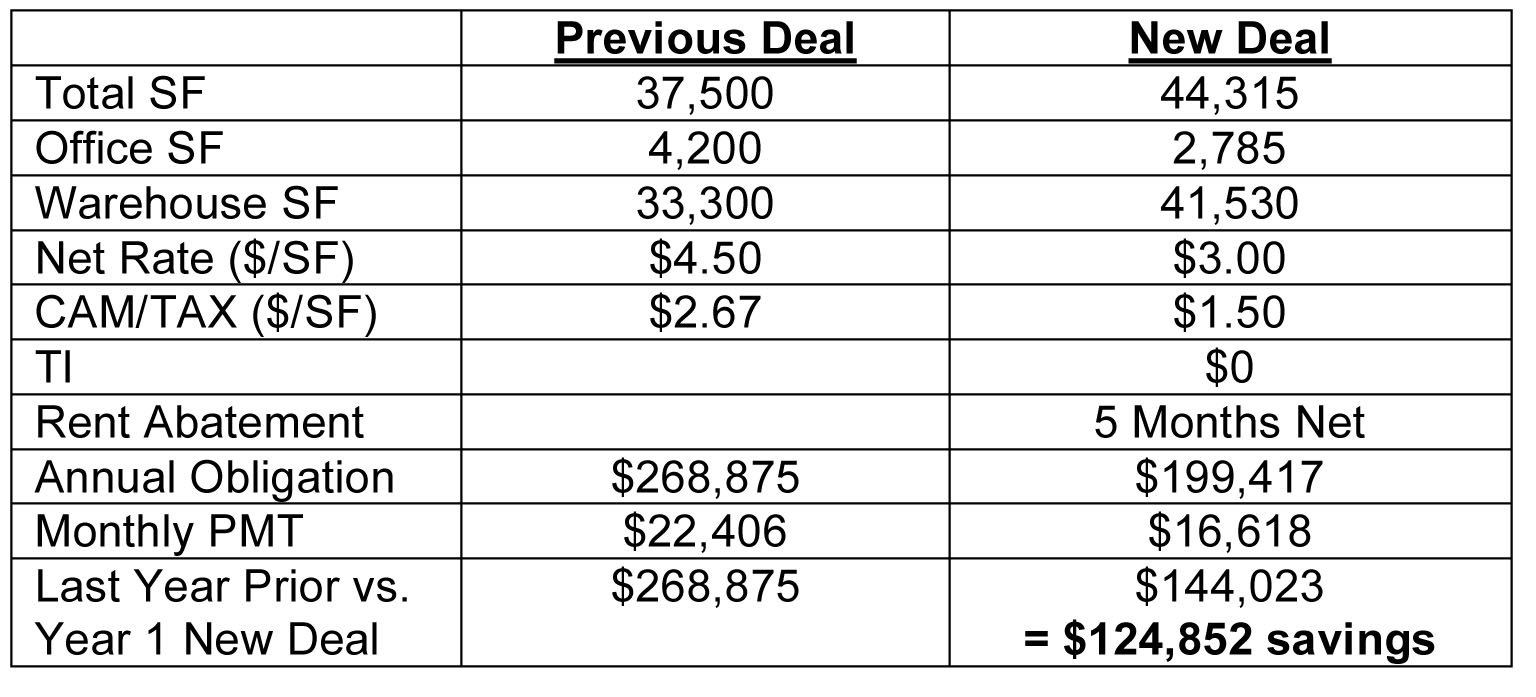

Actual Case Study

This was an excellent example of market knowledge and putting the right parties together at the right time – in the right building. We ensured that our client did not leave “any money on the table.” At the same time we ensured that our relationship with the landlord was maintained and strengthened by being fair, proactive, reasonable, and responsive throughout the entire process.

Owner Occupants

Real estate assets are coming under close scrutiny from the watchful eyes of many executive teams, and reasonably so. For many companies which have historically owned real estate, the liquidity constraints and lack of revenue growth has founded pressures to create cash reserves by examining how to most effectively utilize these assets. This is occurring in many ways and many solutions and ideas have been provided. Each asset and situation is unique and is treated as such. One unconventional twist on the traditional sale/leasebacks that we have observed is the inclusion of a repurchase provision at a certain date at a certain price. This presents flexibility (and hope) as an alternative for entities which prefer to own their real estate, but have determined that at the present time, they must sell an asset. We are assisting our clients by ensuring that their real estate can be most effectively put to use as the assets on balance sheets that they truly are.

Value Creation

The key to creating value has been creative structures and using all available resources in their most efficient manner. Who can most cost effectively build out a space or a building – tenant or landlord? We are seeing more improvements being proposed and completed by tenants directly. Traditional proposals have been passed by and overlooked because both tenants and landlords have been given creative and unconventional deal structures that meet the short and long term objectives of both parties. The resulting equation is: (A) what we are seeing from tenants + (B) what we are seeing from landlords/developers = (C) new market equilibrium. The uncertainty we are faced with and the resulting “squeeze” which we are all feeling is producing deals that have produced a combination of the following attributes:

1 – Shorter lease terms

2 – Reduced capital investment/low improvement funding/ “As-Is deals”

3 – Aggressive and creative rate structures

4 – Abated gross rent rather than abated net rent

5 – Early lease renewals at reduced rates – aka “Blend and Extend”

6 – Security reflective of additional deal specific capital

We are operating in an environment which is uncharted territory to us all. Whether you are a 30-year industry veteran or recent college graduate, the game has changed. The resources available in this market are requiring that we revisit basic real estate fundamentals. We certainly are amidst a conservative reactionary period. Those who will be successful will embrace this new equation and will adapt. As entrepreneurial professionals in all disciplines, the challenge remains to focus on creating opportunities and delivering solutions that are within the desired framework of both tenants and landlords. The window of opportunity has been squeezed from all angles, but it most definitely does still exist.

Click Here to Take Our Survey

The changes we have seen and have been described pose very interesting questions to reflect on. What have we learned as the market has contracted and we find ourselves in this “new” equilibrium? If the market were to suddenly pick up momentum, would you operate as you had during the previous cycle? What would you do differently? To see answers from other owners and tenants, go to www.hiffman.com/newnormalsurvey to take our survey and see our published results.

Larry Much (lmuch@hiffman.com) and Kelly Disser (kdisser@hiffman.com) are industrial brokers with NAI Hiffman and specialize in the Chicagoland Industrial market.