February 2021

7B: Cook County’s lucky number for office tenants

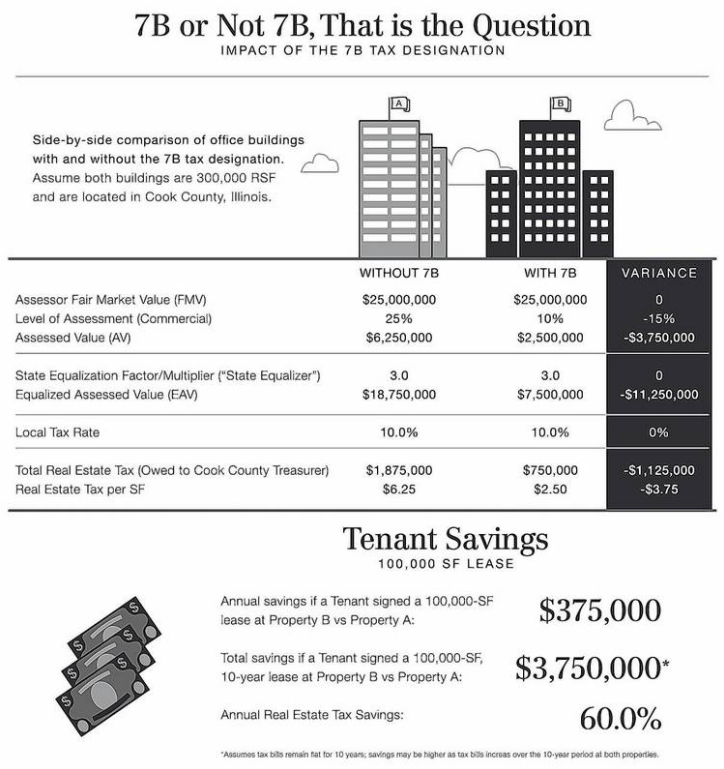

In this eye-opening explainer in the Daily Herald Business Ledger, NAI Hiffman’s Jack Reardon details the bottom-line savings offered by Cook County’s 7B tax incentive, and the massive financial benefits available at suburban Chicago office opportunities such as Golf Tower in Rolling Meadows. Offered by the Cook County Tax Assessor’s Office in conjunction with individual municipalities, the 7B tax incentive reduces the rate at which a commercial property is assessed — dropping it from the normal rate of 25% of “market value” to a 10% rate for the first 10 years, 15% in the 11th year and 20% in the 12th year. Properties with the 7B designation are not common, but as more companies contemplate moving to or expanding office space in the Cook County suburbs — with their lower density, better proximity to a wealth of employee talent that has relocated to the suburbs and lower costs per square foot than the CBD — such properties sweeten the appeal.

Read the full Daily Herald Business Ledger here.