June 2025

Trade Tensions and Real Estate Resilience: How the U.S.–China Standoff is Shaping CRE Demand

By: Dan Worden, Research Analyst

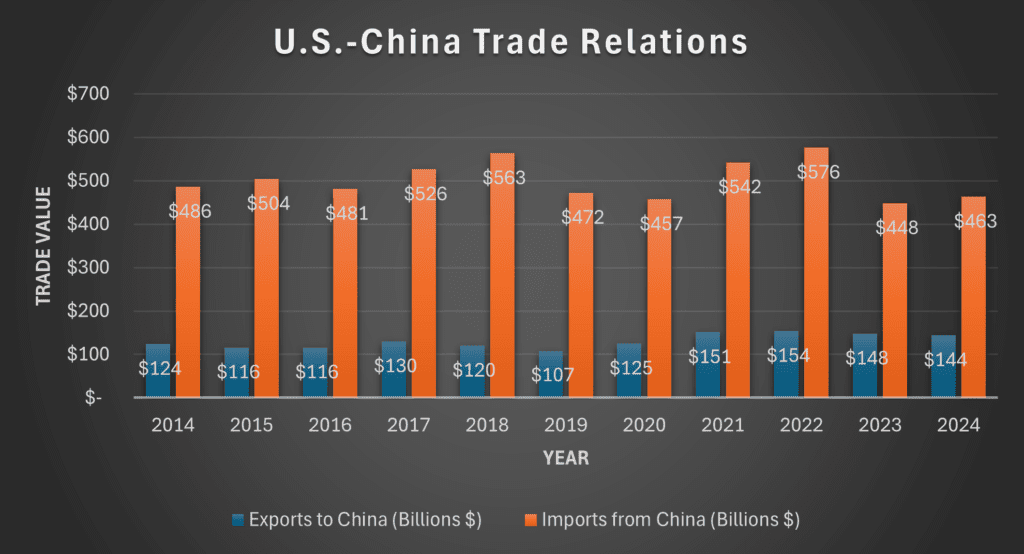

In a world of tariffs and tech bans, the U.S.–China relationship is anything but simple. Imports from China rose 3.3 percent to $463 billion in 2024, while U.S. exports slipped just 2.7 percent to $144 billion—proof that supply‑chain links are being rewired, not severed. For industrial real estate, that recalibration is translating into fresh, highly specialized demand across Chicagoland.

Tariffs, Subsidies, and Strategic Sectors

The U.S. has levied targeted tariffs across electronics, machinery, autos, metals, and consumer goods—backed by subsidies in semiconductors, EVs, renewable energy, defense, and agriculture. China has responded with its own tariffs and export controls, especially in critical minerals like gallium and germanium.

Still, U.S. semiconductor exports to China surged from $6.5B in 2023 to $10.5B in 2024, largely due to China’s lag in chipmaking. Aerospace exports rebounded to a five-year high of $11.5B, while pharma and orthopedic shipments grew steadily.

What does this mean for real estate?

In Chicagoland, it fuels demand for climate-controlled, GMP-compliant, and secure logistics hubs, particularly near O’Hare and DuPage. Aerospace kitting, pharma repackaging, and bulk grain transloading continue to drive absorption in Will County and I-80 corridors.

China’s Exports Aren’t Collapsing—They’re Evolving

Chinese batteries (esp. lithium-ion) rose from $15.8B to $18.1B in imports last year, driven by EV growth. These products require hazardous materials storage, fire safety systems, and fast-turn logistics. In Chicagoland, that means expanded operations in Romeoville, Joliet, and I-55/I-80 corridors.

CRE Impact: Sophistication Over Sheer Scale

Rather than volume alone, today’s logistics facilities must meet specific demands:

• Battery storage: Safety and cross-docking

• Pharma and optics: Climate and security compliance

• Bulk goods: High-clearance, intermodal access

• Retail fulfillment: Dense, cost-efficient 3PL centers

Chicago’s diverse infrastructure—air, rail, interstate, and river—makes it one of the few U.S. regions equipped to support this evolving demand.

Conclusion: A Trade War with Industrial Real Estate Winners

While federal rhetoric continues to emphasize decoupling from China, trade flows and industrial activity reveal a more complex reality. The U.S. and China remain deeply interconnected across key sectors—from semiconductors and aerospace to batteries and consumer goods. What we’re seeing isn’t retreat, but a strategic recalibration—one that’s generating new opportunities for the logistics and manufacturing infrastructure that supports both domestic production and global trade.

For commercial real estate—especially in supply chain-critical markets like Chicagoland—this shifting trade dynamic is fueling sustained demand. Imports of EV batteries, medical devices, and industrial machinery require specialized facilities with temperature control, enhanced safety systems, and secure handling protocols.

Meanwhile, export activity in agriculture, aerospace parts, and pharmaceuticals continues to drive demand for transloading hubs, intermodal facilities, and GMP-compliant warehouse space. Across the region, we’re seeing increased absorption in both traditional bulk space and highly specialized industrial units.

As trade routes adapt and supply chains become more complex, Chicago’s multimodal connectivity and cost-efficient industrial base position it as a long-term beneficiary. The rise in reshoring, onshoring, and export resilience doesn’t eliminate trade with China—it reshapes it. And real estate markets with flexible, future-ready logistics infrastructure—like Chicago—are poised to absorb the gains. In an era of geopolitical volatility, that’s a blueprint for durable growth.

About NAI Hiffman:

NAI Hiffman is one of the largest independent commercial real estate services firms in the US, with a primary focus on metropolitan Chicago, and part of the NAI Global network. We provide institutional and private leasing, property management, tenant representation, capital markets, project services, research, and marketing services for owners and occupiers of commercial real estate. To meet our clients’ growing needs outside of our exclusive NAI Hiffman territory, we launched Hiffman National, our dedicated property solutions division, which provides property management, project services, and property accounting services across the country. NAI Hiffman | Hiffman National is an award winning company headquartered in suburban Chicago, with more than 275 employees strategically located throughout North America.

About Hiffman National:

Hiffman National is one of the US’s largest independent commercial real estate property management firms, providing institutional and private clients exceptional customized solutions for property management, project management, property accounting, lease administration, marketing, and research. The firm’s comprehensive property management platform and attentive approach to service contribute to successful life-long relationships and client satisfaction. As a nationally bestowed Top Workplace, and recognized CRE award winner, Hiffman National is headquartered in suburban Chicago, with more than 275 employees nationally and an additional six hub locations and 25 satellite offices across North America.