July 2022

Mid-Year 2022 Market Watch

NAI Hiffman is pleased to present the Mid-Year 2022 Market Watch, a first look at the market statistics for the Chicago metropolitan office and industrial real estate markets.

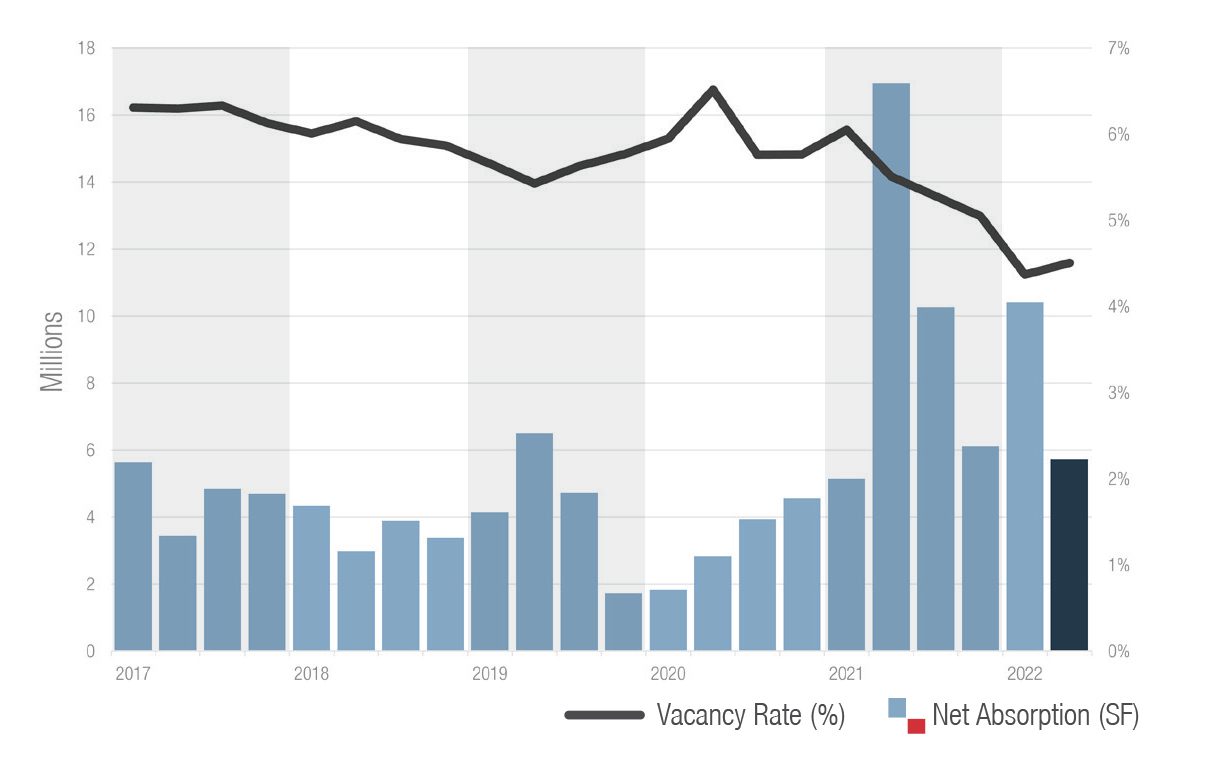

Industrial: Vacancy Remains Below 5.0 Percent

The Chicago industrial market remains red hot mid-way through 2022 featuring historically low vacancy and a continuation of fervent leasing activity. The total vacancy was 4.51 percent, staying below 5.0 percent for the second straight quarter. The vacancy rate rose a mere 14 basis points quarter-over-quarter from the 4.37 percent rate tallied in the first quarter of 2022. The vacancy rate marks a year-over-year improvement of 100 basis points compared to the mid-year 2021 5.51 percent vacancy rate.

- All but one submarket recorded a sub-9.0 percent vacancy rate in the first quarter, while vacancy in an astonishing three submarkets edged below 2.0 percent – I-55 Corridor (1.43 percent), McHenry County (1.56 percent) and Southwest Cook (1.82 percent).

- Vacancy maintained its historic low due to more than 5.7 million square feet of net absorption recorded in mid-year 2022. The I-55 Corridor accounted for an unprecedented 56.9 percent of the quarter’s net absorption figure, as six transactions of 200,000 square feet or larger took occupancy.

- There were 12 deliveries in the construction pipeline in the first quarter, accounting for nearly 2.0 million square feet of new space. There is a record 37.1 million square feet of industrial development currently in the pipeline; build-to-suit developments account for 32.2 percent of the total figure.

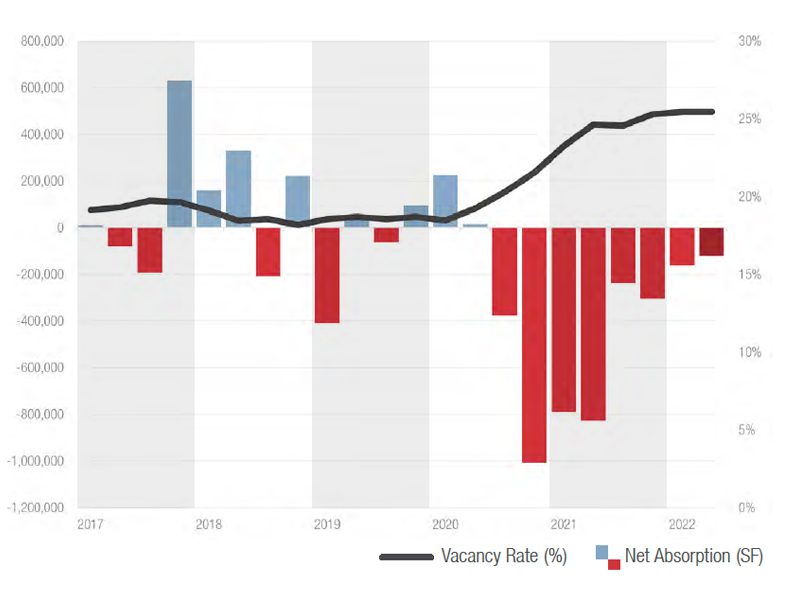

Suburban Office: New Leasing Activity Continues Surge Despite Economic Woes

The suburban Chicago office market recorded 2,074,888 square feet of new leasing activity during the second quarter of 2022, a 17.83 percent increase from the 1,760,881 square feet that was tallied during the first quarter of 2022. Compared to the first quarter of 2020 – the last quarter unaffected by the COVID pandemic – second-quarter leasing activity came within 3.5 percentage points of matching pre-pandemic activity. New leasing activity increased 40.21 percent year-over-year from the 1,479,891 square feet recorded during the second quarter of 2021.

- The East-West Corridor led its suburban office submarket peers with respect to new leasing activity, nearly doubling the figure recorded during the first quarter of 2022 by tallying 1,103,399 square feet during the second quarter. Four of the five suburban submarkets recorded more than 200,000 square feet of new leasing activity during the second quarter: North Suburban, Northwest Suburban, East-West Corridor and O’Hare.

- The largest transaction – by far – occurred in the East-West Corridor, where Ace Hardware signed a 297,127 square foot lease for the former McDonald’s Campus at 2915 Jorie Boulevard in Oak Brook. Ace Hardware is planning to relocate its headquarters in the latter half of 2023, a move from 2200-2222 Kensington Court, the company’s home for more than a decade.

- Suburban office vacancy has yet to reflect these gains in new leasing activity. Direct vacancy dipped by 16 basis points while sublease vacancy increased by 16 basis points, balancing out to leave the total vacancy rate unchanged quarter-over-quarter, at 25.45 percent

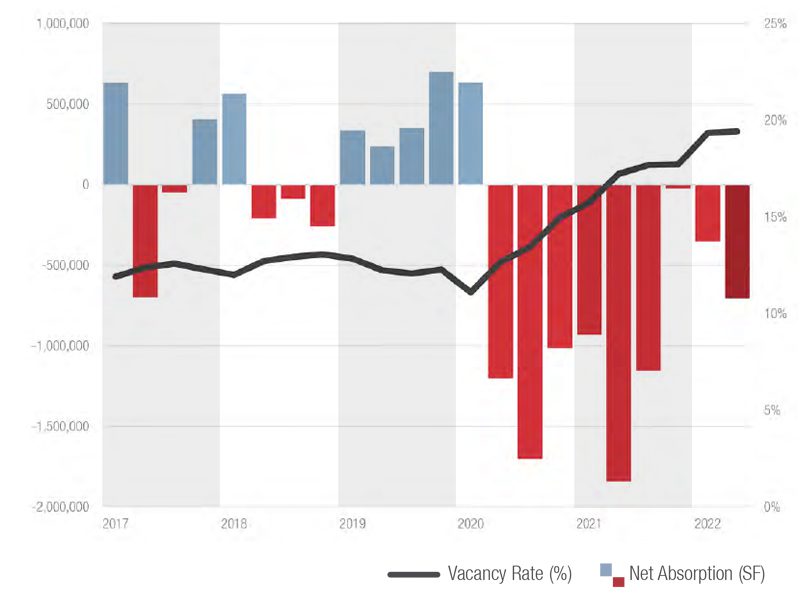

Downtown Office: Downtown Demand Remains Steady

- New leasing activity downtown came in at 1,861,980 square feet during the second quarter, with West Loop again leading all downtown submarkets by recording 769,960 square feet of new leasing.

-

Net absorption was recorded at -705,630 square feet, marking the ninth straight quarter of negative absorption. Two bright spots were Fulton Market at 77,792 square feet and North Michigan Avenue with 15,591 square feet of positive net absorption, respectively.

-

The largest new transaction downtown occurred in Fulton Market, where Boston Consulting Group (BCG) became anchor tenant at 360 N Green Street, leasing roughly 223,000 square feet in the a building set to break ground during the third quarter of this year.

-

Although the pace of leasing activity has stayed relatively steady despite uncertain economic conditions, there are no signs that downtown office employees, nor the employers, are rushing back to the office as vacancy rates have increase in each of the past ten quarters.

Contact Us

Michael Flynn

Chief Operating Officer

630-691-0600

mflynn@hiffman.com