April 2021

First Quarter 2021 Market Watch

NAI Hiffman is pleased to present the First Quarter 2021 Market Watch, a first look at the market statistics for the Chicago metropolitan office and industrial real estate markets.

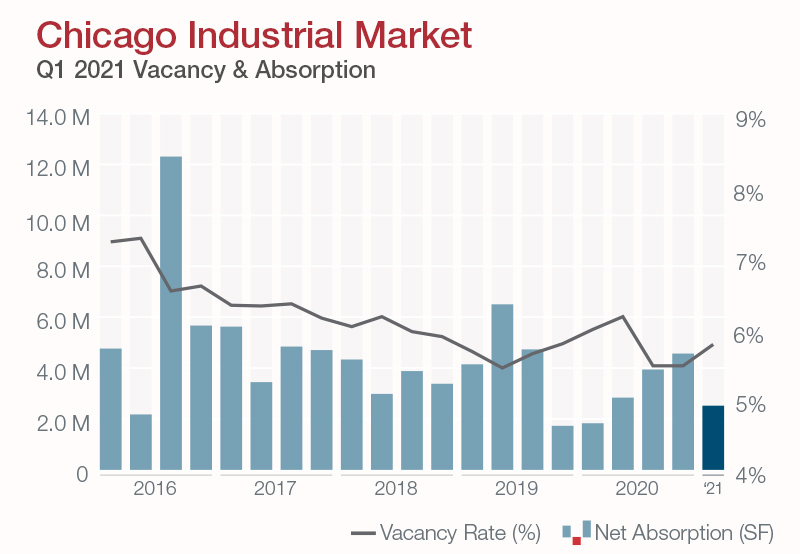

Industrial: Keeping Momentum Despite the Ongoing Pandemic

Chicago industrial continued its impressive run of activity through the first three months of 2021 despite the ongoing disruptions caused by the Covid-19 pandemic. The total vacancy rate was 5.76 percent. While this rate increased 30 basis points compared to the year-end 2020 rate of 5.46 percent, it decreased 19 basis points year-over-year compared to the 5.95 percent vacancy rate from the first quarter of 2020.

- Leasing activity remained robust at the start of 2021, as over 17.0 million square feet of deals were recorded.

- Net absorption exceeded 2.5 million square feet to start 2021.

- There is currently nearly 23.2 million square feet of industrial properties currently under construction in the market, spread across 59 developments.

Detailed statistics and commentary are available in the Industrial Market Watch; click below to download the full document

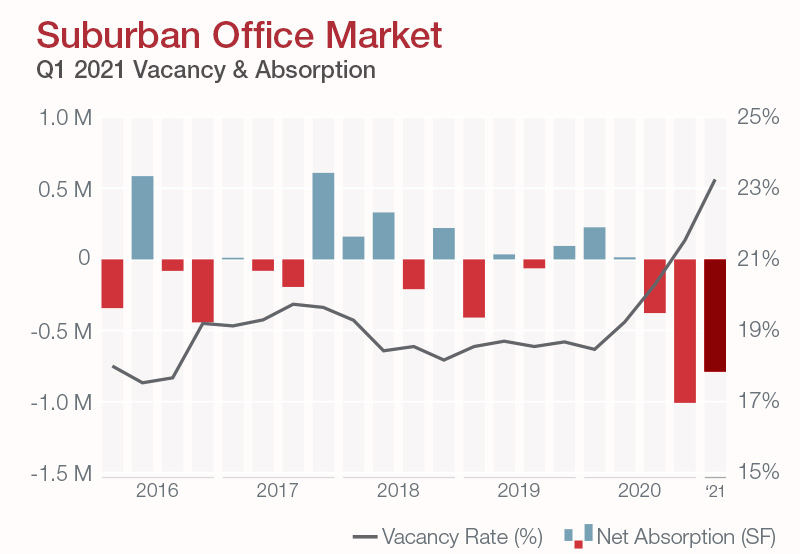

Suburban Office: Subleases Hold Steady in the First Quarter

The suburban Chicago office market ended the first quarter of 2021 with a 23.25 percent vacancy rate. This rate increased 478 basis points year-over-year from the 18.47 percent vacancy rate recorded in the first quarter of 2020. This vacancy rate also reflected an increase of 171 basis points from the year-end 2020 vacancy rate of 21.54 percent. The I-55 Corridor led its submarket peers with a 13.11 percent vacancy rate, while the next lowest submarket rate was O’Hare which recorded a 17.79 percent vacancy rate.

- The sublease vacancy rate, which had been steadily increasing since the onset of the Covid-19 pandemic, remained unchanged at 1.47 percent compared to the year-end 2020 rate. On a positive note, the sublease vacancy rate in suburban Class A space decreased by 10 basis points in the first three months of 2021.

- There was -789,489 square feet of net absorption recorded in the first quarter. For the fourth consecutive time since Q2 2020, the suburbs outpaced the downtown office market, which saw -931,663 square feet of space return to the market in the first quarter.

For full statistics and commentary, download the Suburban Office Market Watch.

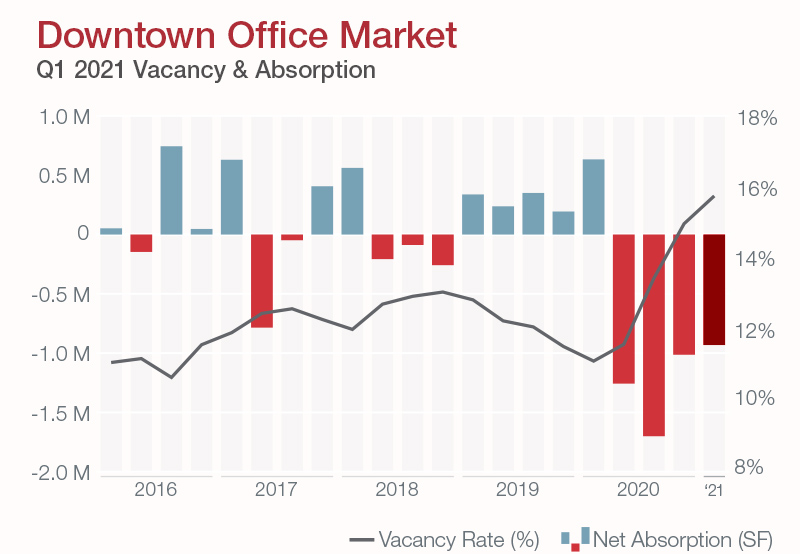

Downtown Office: The Pandemic Isn’t In Chicago’s Rearview Mirror Just Yet

In the fourth full quarter of pandemic conditions, the downtown Chicago office market struggled to put 2020 in its collective rearview mirror. The downtown vacancy rate at the end of the first quarter was recorded at 15.75 percent. This rate increased 78 basis points quarter-over-quarter from the year-end 2020 vacancy rate of 14.97 percent. More notably, the vacancy rate has increased 464 basis points year-over-year compared to the first quarter 2020 vacancy rate of 11.11 percent.

- There were another -931,663 square feet of net absorption in the first quarter downtown, a marginal improvement after three consecutive quarters of greater than -1.0 million square feet of net absorption. At 156,903 square feet, the Fulton Market/Near West Side submarket was the only downtown submarket to record positive absorption on the quarter.

- There was 1,136,567 square feet of leasing activity downtown to start the year.

- Three projects in the downtown development pipeline delivered in the first quarter of 2021, adding another 313,000 square feet of inventory.

Download the CBD Office Market Watch for full statistics and commentary.

Contact Us

For further information regarding the content of this market peek, please contact:

Mike Morrone

Research Director

630-693-0645

mmorrone@hiffman.com