May 2023

Rising Insurance Rates & the Road Ahead

What the forecast is telling us about the real estate insurance market

Property Insurance in Deep Water

In the past six years, the combined effects of several key events have helped create a property market that is proving to be exceptionally challenging for the CRE industry.

Among the contributing factors are — inflation affecting loss costs, the prospect of significantly higher reinsurance rates, carrier losses from primary perils and repricing for secondary perils.

Over the past four years, we have slowly been moving into a hard property insurance market.

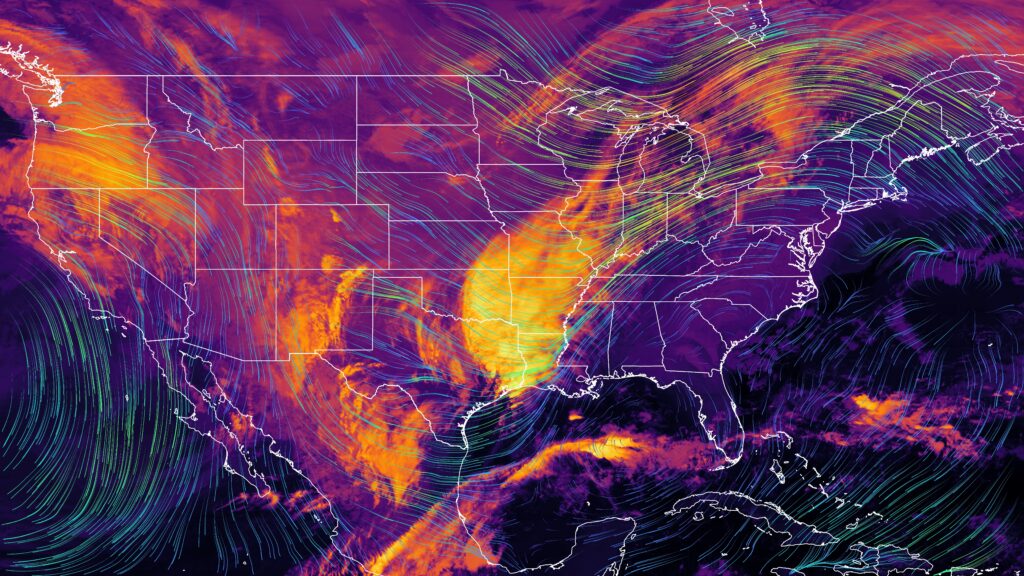

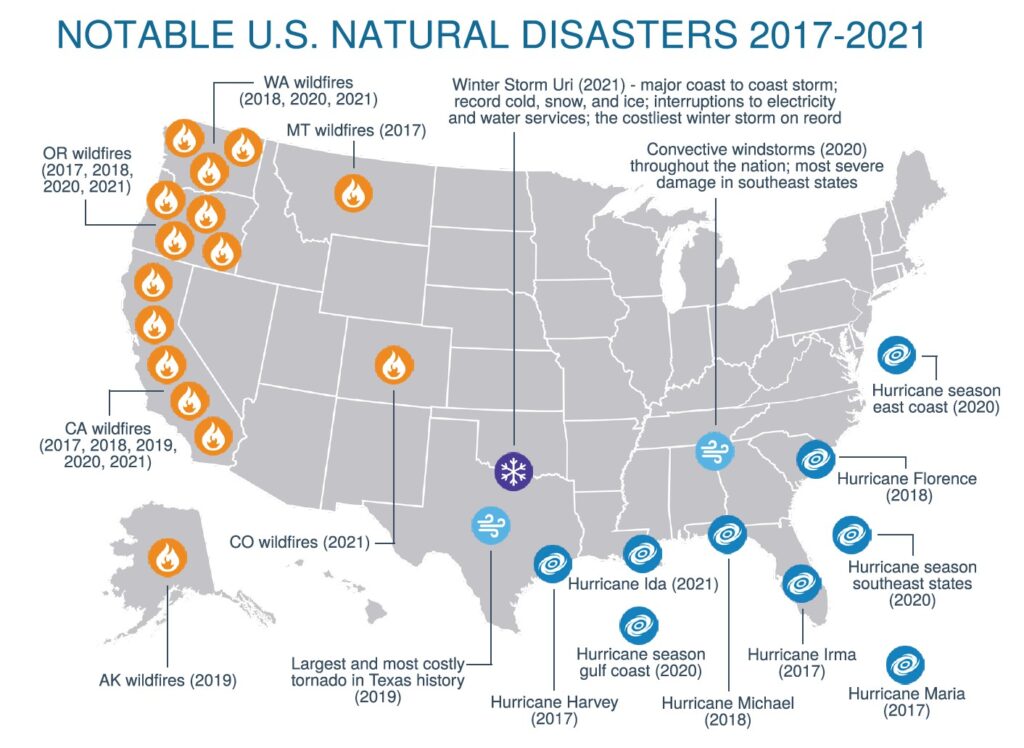

Prior to 2017, the US property market was soft with historically low valuation. Prices were competitive, and coverage was easy to come by. However, the significant rise of natural disasters across the nation over the past five years has seen a continual hardening of the market. While the US claim losses have historically been due to hurricanes, other events have also become significant contributing factors. The western region has incurred its most costly wildfire expenses to date, and common localized events, particularly convective windstorms, are also incurring higher expenses and impacting the market.

2017 – 2021 was the largest 5-year loss span for insurance carriers in modern history, with over half a trillion dollars of property insurance losses. This was after years of relatively low claims activity and a soft market at the time characterized by extremely low rates. The crucial thing to remember is that insurance carriers, specifically reinsurance carriers, are global companies. They have exposure to hurricanes in Florida/Louisiana/Texas, the massive growth of wildfires on the West Coast, and European flooding and typhoons in the Asian Pacific. So, although the claim activity in the Midwest is much less than in the prior described regions, the industry as a whole is experiencing a hard market – characterized by rate increases and coverage restrictions.

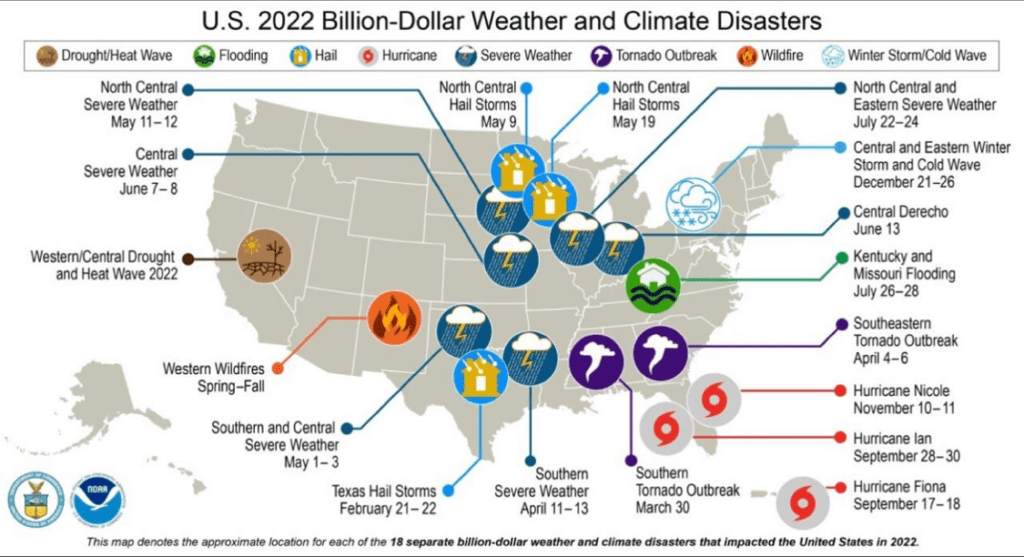

2022 presented 18 billion-dollar property loss events, of which Hurricane Ian alone is projecting property losses reaching $60 billion, which is proving to be the ultimate breaking point.

Due to these heavy losses, many carriers have pulled out of providing property insurance nationwide. Reinsurers who take on these losses and primary carriers who push risk off their books have increased the cost of reinsurance. They also are not providing any more capacity while constricting the capacity they were previously putting out. This trickles down directly to the primary insurance carriers that insure our clients. As a result, rates are increasing, and more carriers are needed to fill property values.

Florida, Louisiana, and Texas, the Hurricane/Heavy catastrophe states, are seeing this the worst, with premium increases of 100%-400% common. Secondary factors such as the type of property construction and the year built play a role in how significant increases will be.

Non-CAT exposed, or non-catastrophic exposed properties, as seen in the Midwest, are seeing 5%-20% factors simply due to the overall hard Property Insurance market.

A final factor that is contributing to the hard market is building valuation. During the hard market years, carriers and underwriters were not paying much attention to the Replacement Cost values of properties that property owners would insure. After years of claims data seen by these carriers, they now require all property owners with undervalued schedules to increase their property values. This is also driven by the current state-of-the economy/inflation/supply chain and labor shortage issues. While this will vary by region, it is causing premium increases even before market factors take effect because the premium is rated off the overall property limits – higher insured limit = higher premium.

Forecast Ahead

While there is no lack of carriers in the marketplace, the maximum limit carriers are willing to offer has shrunk significantly. With less capacity output, multiple shared and layered solutions have become more common and are routinely needed to replace capacity.

What do you need to know to navigate the hardening market and create a strong portfolio?

Mitigate Risk – understand that proactive measures can help with your renewal. If you are on top of issues like loss control, routine property maintenance, and reporting the safety features and protocols they have in place help make your risk more appealing to markets.

Risk Retention – Revisit your ability to retain risk by evaluating acceptable deductible structures and the lowest limits you can reasonably take on. It’s also important to understand you should do everything possible to close open claims.

Quality Submissions – Great submissions get faster attention. Differentiate yourself by including all secondary information that helps create a clear picture of your business and risk. It’s also important to get submissions to the market at least 30 days out.

Partner with a Specialist – A specialist who truly understands CRE is critical. They will know the ins and outs of the market and will have strong, established relationships with carriers. They are equipped to provide retailers with the best tools available to properly address each risk and have the ability to negotiate with carriers on your behalf.

As your trusted commercial real estate advisor, we take pride in offering unparalleled expertise on industry news and topics. Our team of dedicated professionals are committed to providing personalized solutions that meet the unique needs of each client. When it comes to commercial real estate, you can trust Hiffman to guide you each step of the way.

Tyler Linabury, CIC Commercial Insurance Advisor Brown & Brown, Inc.

Tyler.Linabury@bbrown.com O (727) 450-7125 | C (813) 728-8608

Hiffman National

One Oakbrook Terrace, Suite 400 Oakbrook Terrace, IL 60181

833 HIFFMAN

NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2023). https://www.ncei.noaa.gov/access/billions/, DOI: 10.25921/stkw-7w73

About Hiffman National:

Hiffman National is one of the US’s largest independent commercial real estate property management firms, providing institutional and private clients exceptional customized solutions for property management, project management, property accounting, lease administration, marketing, and research. The firm’s comprehensive property management platform and attentive approach to service contribute to successful life-long relationships and client satisfaction. As a nationally bestowed Top Workplace, and recognized CRE award winner, Hiffman National is headquartered in suburban Chicago, with more than 250 employees nationally and an additional six hub locations and 25 satellite offices across North America.