December 2020

Suburban Single-Story Office Market Report: Third Quarter 2020

Third Quarter Suburban Single-Story Office Report

Despite persistent challenges stemming from the ongoing pandemic, leasing activity in the suburban Chicago single-story office market actually improved 31.8 percent compared to the the third quarter of 2019.

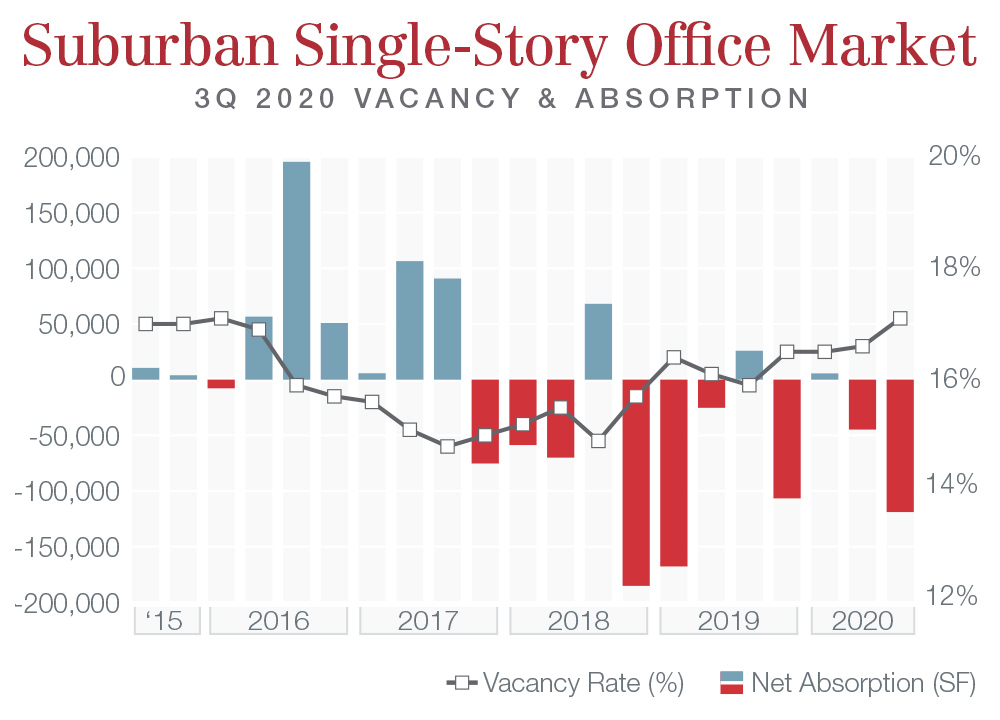

- After three consecutive quarters of steady performance, the 3Q 2020 suburban single-story vacancy rate grew to 17.14 percent, increasing 129 basis points year-over-year from Q3 2019’s 15.85 percent.

- For the second consecutive quarter, the O’Hare office submarket saw vacancy decline year-over-year, moving from 17.59 percent to 13.35 percent. Conversely, the steepest increase in vacancy year-over-year was found in the I-55 Corridor submarket. Despite softening 344 basis points from Q3 2019’s 11.59 percent, the submarket’s current 15.03 percent vacancy rate remains the second tightest amongst its peer submarkets at present.

- Net absorption in the third quarter was -118,824 square feet, the second consecutive quarter where the market gave back space. Despite recording -158,012 square feet of net absorption year-to-date, single-story office net absorption actually improved 12.9 percent compared to the first nine months of 2019. The O’Hare submarket leads its peer submarkets year-to-date with 28,612 square feet of net absorption.

There were 90 deals in the suburban Chicago single-story office market in the third quarter, more than doubling the 44 deals recorded in the previous quarter. The nearly 284,000 square feet of leasing activity recorded in the third quarter represented a 163.7 percent increase compared to 2Q 2020. The third quarter figures also compare favorably to one year prior, when 89 deals accounted for 215,408 square feet of activity. Despite a difficult second quarter, year-to-date leasing activity is actually above 2019’s pace by 1.9 percent. Notably, there were multiple lease transactions in the third quarter where tenants originated from multi-story buildings.

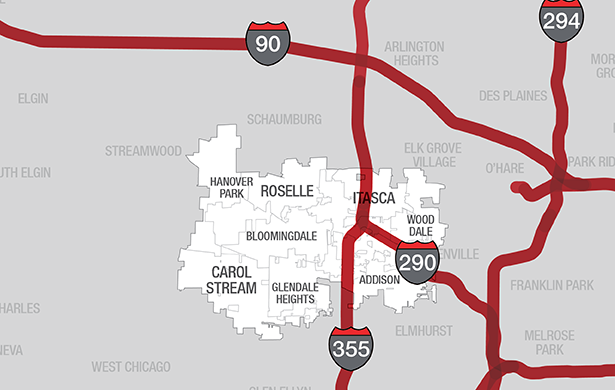

Additionally, the report includes a highlight of the North DuPage micro-market. Part of the Northwest Suburban submarket, the North DuPage micro-market recorded an 8.8 percent vacancy rate in its single-story office market, a 270 basis point decline year-over-year.

Comprehensive details with in-depth charts and graphs can be seen in our full report:

About the Single-Story Office Report

NAI Hiffman is now the single source for Suburban Single-Story Office Quarterly Reporting, a first look focused at the ground-level for the Chicago metropolitan area.

In this evolving office market, NAI Hiffman brokers Jason Wurtz and Steve Chrastka felt Chicago’s single-story buildings deserved a closer look. NAI Hiffman’s Research Department worked with the brokerage team to break out specific statistics related to that data set. These resulting numbers are an in-depth look at a vibrant market potentially becoming even more relevant as companies explore new ways to work.

2020’s volatility perhaps makes it a strange year to begin an in-depth track of a previously untapped portion of the larger market, however, the logic of the Single-Story Office Report is based on the concept that more detail leads to better insight. Anecdotes and speculation are plentiful while hard facts are in shorter supply, so the goal of the quarterly report is to follow trends and separate fact from fiction.

Contact Us

Mike Morrone

Research Director

630-693-0645

mmorrone@hiffman.com