May 2024

Spec vs Build-To-Suit Development Ratio Reflects the Changing Industrial Market

From the May 23, 2024, article “Industrial Build-To-Suits Overtake Spec Developments As Chicago Developers Lose Appetite For Risk ” in BISNOW

by Ryan Wangman

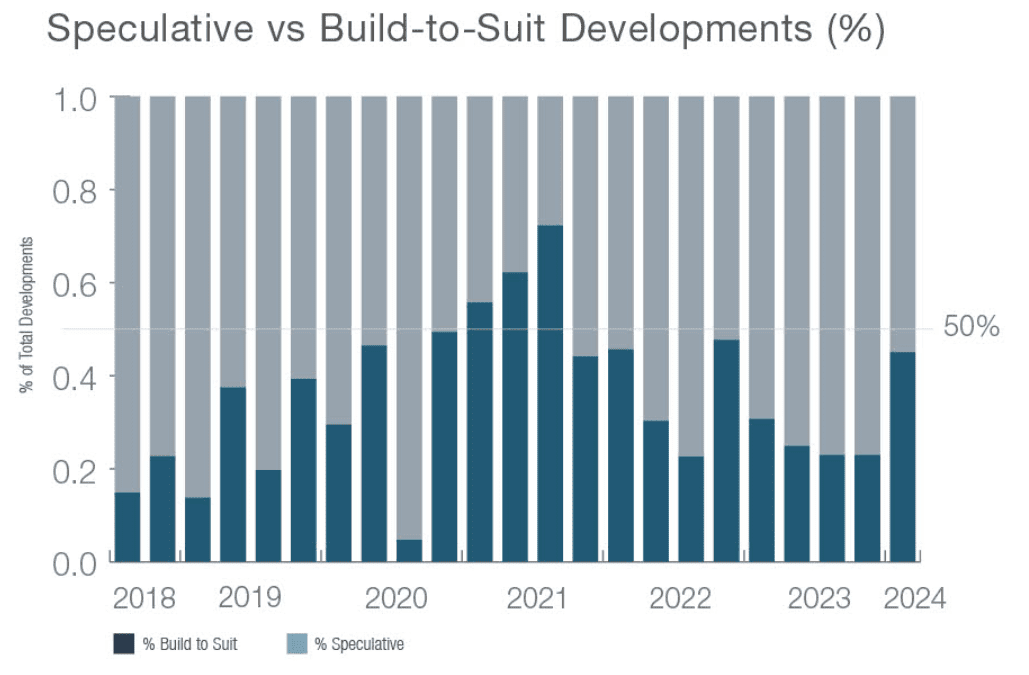

Developers in Chicago’s industrial market are starting to shift new construction projects from speculative buildings to build-to-suit developments as demand lags behind an onslaught of new supply that has come online in the past couple of years.

Of the 10 new industrial construction starts in Q1, six were build-to-suit projects, making up 2.3M SF of the 2.7M SF that broke ground in the quarter, according to a Q1 2024 industrial report from NAI Hiffman. In total, 13.4M SF of industrial properties are currently under construction as of the start of Q2, with spec projects making up 7.4M SF of active projects, or 55.3%, data from NAI Hiffman shows.

This is a marked contrast from the first quarter of 2023, when developers were building 41.2M SF of industrial properties, with 81% going up as speculative buildings and 19% as build-to-suit facilities, according to NAI Hiffman.

“We’ve started to see a shift in the strategic direction of developers and their attitudes towards new construction, with developers adopting a more conservative approach,” said Nick Schlanger, director of research services at NAI Hiffman.

Vacancy rates for industrial properties have continued to tick up over the past several quarters, settling at 5.7% as of Q1, according to NAI Hiffman. Since the first quarter of 2023, developers have completed 37.6M SF of industrial property, with 24.5M SF still available and 13.1M SF sold or leased.

Developers are now more likely to wait to sign a major tenant before breaking ground on a new industrial project, Schlanger said. In recent years, the “unabated” demand for industrial space from large, big-box industrial tenants led to developers flooding the market with spec developments, he said.

“Space was just flying off the shelves,” Schlanger said. “It was really a ‘if you build it, they will come’ mentality. And we saw that product lease very well. But now we’re seeing a pullback in demand from those major tenants, and developers have adjusted.”

Schlanger said developers are being realistic about current levels of demand and not speculating on potential growth that might come over the next 24 months. He said this is a marked contrast to a metro like Dallas, which has triple the amount of inventory currently under construction that Chicago does despite a 9.5% vacancy rate.

Local developers are taking less risk than those in other markets, Schlanger said.

Looking to the future, Schlanger said new supply expected to come online in 2024 is still anticipated to outpace demand by about 5M SF. However, with a slowdown in new construction starts, demand for space may overtake supply in the back half of next year.

“I think we’re going to start to see over the second half of 2025 is really when demand will likely begin to outpace that new supply as most everything will be delivered by that point,” Schlanger said.

Contact Us

Nick Schlanger

Director of Research Services

630-691-0600

nschlanger@hiffman.com

About NAI Hiffman:

NAI Hiffman is one of the largest independent commercial real estate services firms in the US, with a primary focus on metropolitan Chicago, and part of the NAI Global network. We provide institutional and private leasing, property management, tenant representation, capital markets, project services, research, and marketing services for owners and occupiers of commercial real estate. To meet our clients’ growing needs outside of our exclusive NAI Hiffman territory, we launched Hiffman National, our dedicated property solutions division, which provides property management, project services, and property accounting services across the country. NAI Hiffman | Hiffman National is an award winning company headquartered in suburban Chicago, with more than 250 employees strategically located throughout North America.

About Hiffman National:

Hiffman National is one of the US’s largest independent commercial real estate property management and advisory firms, providing institutional and private clients exceptional customized solutions for property management, facility management, advisory services, accounting, lease administration, lender services, project management, marketing, and research. The firm’s comprehensive property management platform and attentive approach to service contribute to successful life-long relationships and client satisfaction. As a nationally recognized Top Workplace, and perennial CRE award winner, Hiffman National is headquartered in suburban Chicago, with more than 250 employees nationally and an additional six hub locations and 25 satellite offices across North America.