June 2022

Suburban Single-Story Office Market Report: First Quarter 2022

Deal Activity Approaches 2018 Levels

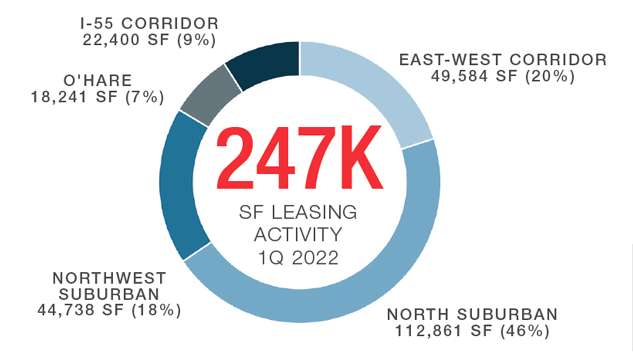

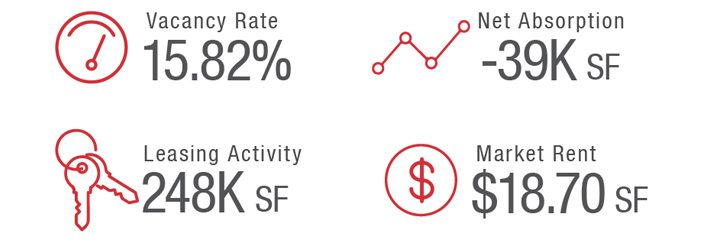

The suburban single-story office market recorded 247,824 square feet of leasing activity in the first quarter across 112 deals. This was a 61.6 percent increase quarter-over-quarter from the 153,331 square feet of activity tallied in the fourth quarter of 2021. Despite this increase, leasing activity decreased 19.6 percent year-over-year.

- While leasing activity decreased year-over-year, there were 11 more deals completed in the first quarter compared to the 101 deals signed in the first quarter of 2021. This was the strongest

first quarter of deal activity since the 120 deals signed in the first three months of 2018. In addition, leasing activity increased 2.6 percent compared to the first quarter of 2020 — the final

quarter not wholly affected by the Covid-19 pandemic. - There was -39,493 square feet of net absorption in the suburban single-story office market in the first quarter. Despite two consecutive quarters of negative net absorption, the metric increased 75.3 percent quarter-over-quarter from the -159,709 square feet of net absorption tallied in the fourth quarter of 2021.

- The single-story market had a 15.82 percent vacancy rate through the first three months of 2022. The rate stayed relatively unchanged from the 15.86 percent rate recorded in the first quarter of 2021.

- Notable deals signed in the first quarter include Intellihot leasing 16,522 square feet at 750 E Bunker Ct in the Continental Executive Park in Vernon Hills and Multivac leasing 12,390 square feet at 2400 Ogden Ave in Lisle in the East-West Corridor. In addition, the Illinois Bone & Joint Institute renewed 16,542 square feet at Executive Place III in Westmont.

Additionally, the report includes a highlight of the Eastern East-West single-story market, which recorded a 12.96 percent total vacancy rate in the first quarter of 2022, a decrease of 57 basis points quarter-over-quarter from the 12.77 percent vacancy rate tallied in the final quarter of 2021.

Comprehensive details with in-depth charts and graphs can be seen in our full report:

Contact Us

Michael Flynn

COO

630-691-0600

mflynn@hiffman.com