February 2021

Suburban Single-Story Office Market Report: Year-End 2020

Year-End Suburban Single-Story Office Report

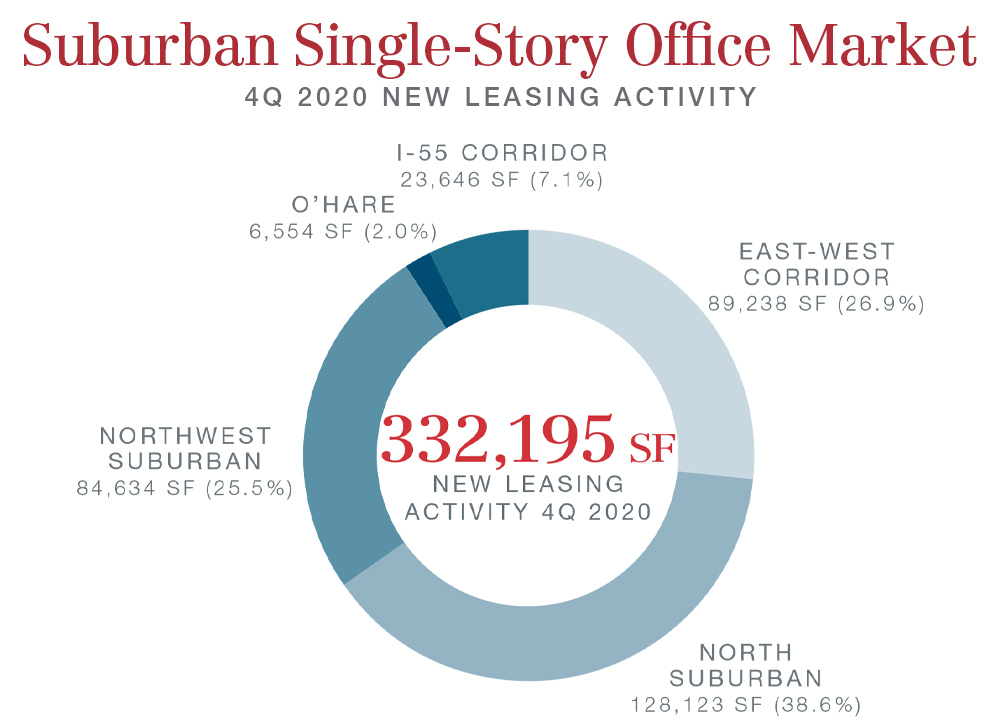

There was 332,195 square feet of leasing activity in the fourth quarter – the largest figure since the 367,540 square feet recorded in the first quarter of 2017; full-year 2020 leasing activity increased 9.8 percent compared to 2019.

- The fourth quarter suburban single-story total vacancy rate was 17.3 percent to end 2020, increasing 17 basis points from the previous quarter. The rate increased 87 basis points in comparison to year-end 2019’s 16.43 percent total vacancy rate.

- Amongst peer submarkets, O’Hare was the only submarket to see a decline in total vacancy year-over-year. The rate fell 416 basis points from the 16.59 percent rate recorded in the fourth quarter of 2019 to the year-end 2020 rate of 12.43 percent. Despite a 305-basis point increase in total vacancy year-over-year, the I-55 Corridor’s 15.53 percent rate remained the second tightest submarket at year-end.

- There was 332,195 square feet of leasing activity across 78 deals in the fourth quarter – the largest figure since the 367,540 square feet of leasing activity recorded across 123 deals in the first quarter of 2017. There was 988,643 square feet of leasing activity throughout 2020, a 9.8 percent increase over the 900,485 square feet of leasing activity recorded in 2019.

Despite direct net absorption recording its first positive, if modest, figure since the first quarter of 2020, unfortunately total net absorption in the fourth quarter ended at -36,958 square feet due to the increase in sublease offerings. There was positive net absorption in three of the five submarkets – North Suburban (22,275 square feet), O’Hare (6,979 square feet), and the East-West Corridor (5,609 square feet). While full-year net absorption was -193,814 square feet, this represented a marked 37.7 percent improvement over the -311,145 square feet of net absorption recorded throughout 2019. At 35,591 square feet, O’Hare was the only submarket to record a positive full-year net absorption figure.

Additionally, the report includes a highlight of the Central North single-story micro-market. Part of the North Suburban submarket, the Central North micro-market recorded a 16.08 percent vacancy rate in its single-story office market, a 59 basis point decline year-over-year.

Comprehensive details with in-depth charts and graphs can be seen in our full report:

About the Single-Story Office Report

NAI Hiffman is now the single source for Suburban Single-Story Office Quarterly Reporting, a first look focused at the ground-level for the Chicago metropolitan area.

In this evolving office market, NAI Hiffman brokers Jason Wurtz and Steve Chrastka felt Chicago’s single-story buildings deserved a closer look. NAI Hiffman’s Research Department worked with the brokerage team to break out specific statistics related to that data set. These resulting numbers are an in-depth look at a vibrant market potentially becoming even more relevant as companies explore new ways to work.

2020’s volatility perhaps makes it a strange year to begin an in-depth track of a previously untapped portion of the larger market, however, the logic of the Single-Story Office Report is based on the concept that more detail leads to better insight. Anecdotes and speculation are plentiful while hard facts are in shorter supply, so the goal of the quarterly report is to follow trends and separate fact from fiction.

Contact Us

Mike Morrone

Research Director

630-693-0645

mmorrone@hiffman.com