October 2021

Third Quarter 2021 Market Watch

NAI Hiffman is pleased to present the Third Quarter 2021 Market Watch, a first look at the market statistics for the Chicago metropolitan office and industrial real estate markets.

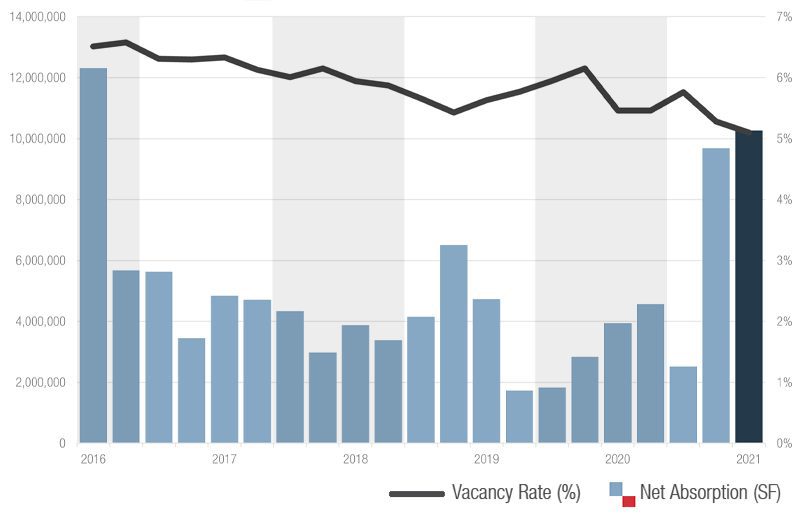

Industrial: The Incredible Shrinking Industrial Vacancy Rate

Industrial Chicago’s momentum continued in the third quarter. The total vacancy rate decreased throughout the Chicagoland area to 5.1 percent, tightening 18 basis points from the second quarter’s 5.28 percent rate. Additionally, the vacancy rate decreased 36 basis points year-over-year from the third quarter 2020 rate of 5.46 percent. The market absorbed nearly 10.3 million square feet, the highest figure in five years.

- All 21 submarkets throughout industrial Chicagoland remained below double-digit vacancy in the third quarter. Both the Fox Valley submarket and (for the second quarter in a row) the Southwest Cook submarket recorded the tightest vacancy rates with an impressive 2.57 vacancy rate, a 40 basis point decrease from last quarter’s 2.97 percent rate.

- Eleven of the 21 submarkets recorded vacancy rates below 5.0 percent this quarter.

- Leasing activity kept up its pace in the third quarter as new deals totaling 14.35 million square feet were signed. This quarter saw five deals over 500,000 square feet signed, led by Amazon’s almost 1.2 million square foot commitment at 11400 Venture Ct in Huntley for a build-to-suit development.

- Despite 21 properties totaling 10.3 million square feet delivering in the third quarter of 2021, the overall market vacancy rate still decreased.

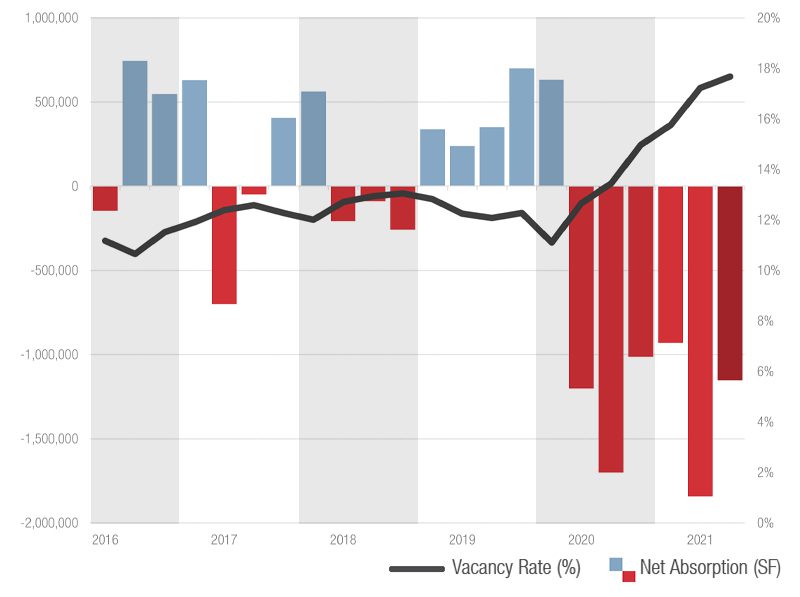

Suburban Office: First Decrease in Vacancy Since the Start of 2020

- Suburban Chicago office recorded 1,731,187 square feet of new leasing activity in the third quarter of 2020.This represented a 62.3 percent increase year-over-year from the nearly 1.1 million square feet of new leasing activity tallied in the third quarter of 2020.

- The East-West Corridor submarket led the way amongst its peer suburban submarkets with 602,657 square feet of activity; the Northwest Suburban submarket notched a comparatively strong second place with 520,452 square feet.

- Despite the delta variant supplying yet another headwind for the suburban Chicago office market, the first vacancy decrease during the pandemic and the second consecutive quarter of new leasing activity in excess of 1.4 million square feet provide distinct glimmers of hope of a market finally regaining its footing in a changed landscape.

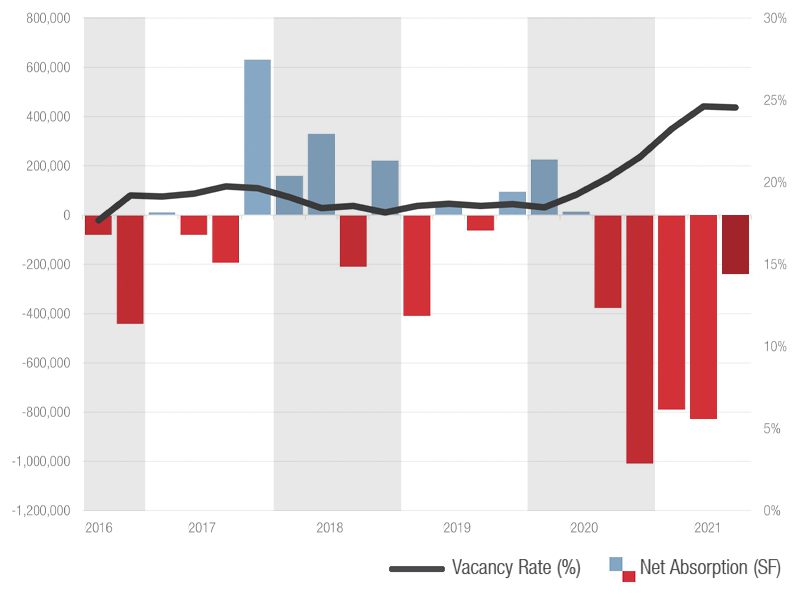

Downtown Office: Despite Improved New Leasing Activity, Vacancy Rate Climbs for Sixth Consecutive Quarter

- The CBD office market recorded 2,530,100 square feet of new leasing activity in the third quarter – the first quarter where this metric topped 2.0 million square feet since the pandemic began in the first quarter of 2020. Law firm Kirkland & Ellis signed the largest downtown office lease since the first quarter of 2009, taking 662,400 square feet of space at Salesforce Tower Chicago in River North. The 59-story, 1.2-million-square foot skyscraper is slated to deliver in the first quarter of 2023.

- Despite several tenants moving into their recently delivered spaces in the Fulton Market submarket, there was -1,153,984 square feet of net absorption overall in the downtown office market in the third quarter. This marks the sixth consecutive quarter that the CBD has recorded negative net absorption and the second consecutive quarter of negative net absorption in excess of -1.0 million square feet. Despite this, year-over-year net absorption increased 32.1 percent from the -1.7 million square feet of space that returned to the market in the third quarter of 2020.

- Despite the downtown office market’s vacancy rate creeping up further on the back of a sixth consecutive quarter of negative net absorption, the increased leasing velocity in both headline deals and overall leasing figures indicate that the uncertainty driven by pandemic conditions may be beginning to ebb.

Contact Us

Mike Morrone

Research Director

630-693-0645

mmorrone@hiffman.com