November 2022

Third Quarter 2022 Market Reports

NAI Hiffman is pleased to present the Third Quarter 2022 Market Reports, an in-depth look at the market statistics for the Chicago metropolitan office and industrial real estate markets.

Industrial Fundamentals Strong Heading Towards End of Year

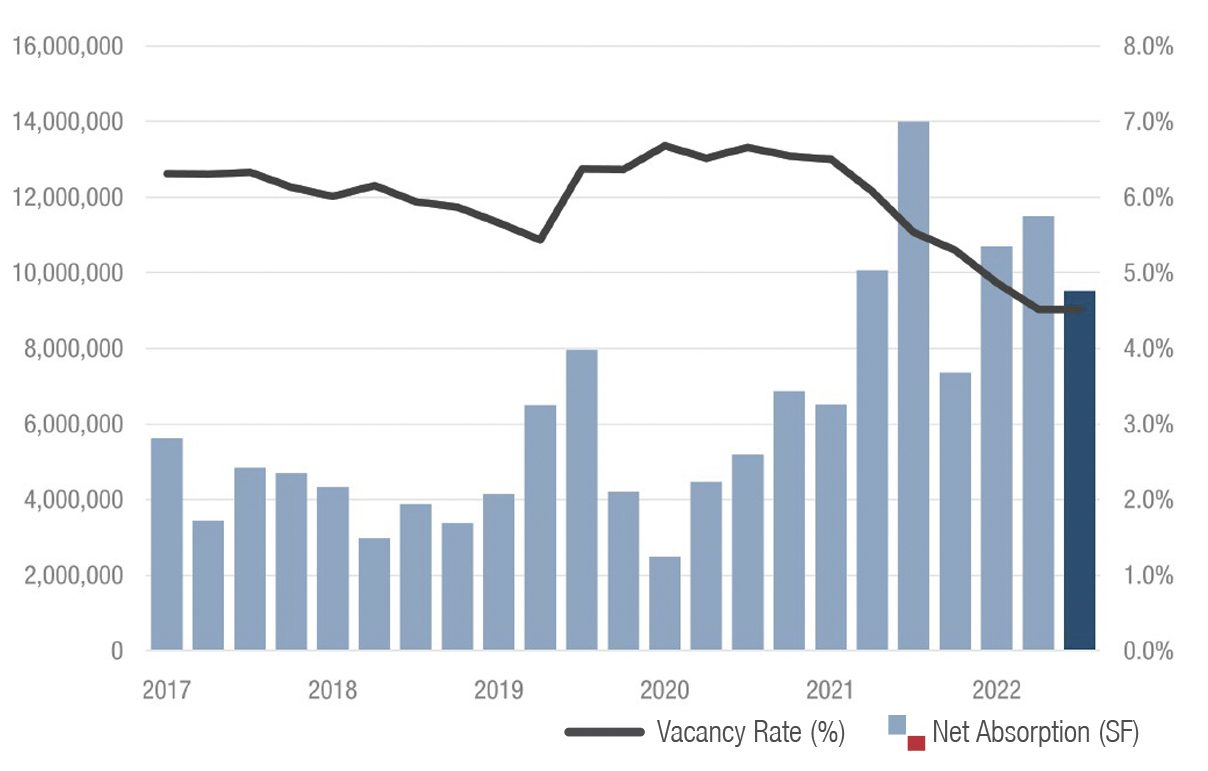

Chicago’s industrial market maintained substantial growth in the third quarter of 2022, as surging demand continues to drive feverish leasing activity and robust new development. The region saw 9.5 million square feet of positive net absorption during the third quarter, bringing year-to-date absorption to 31.7 million square feet— the highest in the nation. The 4.5 percent overall vacancy rate remained unchanged from the second quarter, despite nearly 9.5 million square feet of new deliveries. Chicago’s development pipeline remains robust, with 32.4 million square feet currently under construction. With ever-increasing pressure on the global supply chain, Chicago remains uniquely positioned for sustained growth, as its centralized location and expansive transportation infrastructure continue to draw major industrial players to the region.

- Chicago registered 9.4 million square feet of leasing activity during the third quarter, bringing year-to-date leasing to 43.5 million square feet. While the total represents a moderate decline from 12.9 million square feet last quarter, demand for new warehousing and logistics space remains elevated.

- Vacancy remains tight at 4.5%, the third consecutive quarter of sub- 5.0% overall vacancy. Two submarkets edged below 2.0 percent vacancy during the third quarter: I-55 Corridor (1.2 percent) and Southwest Cook (1.9 percent). Additionally, all submarkets recorded vacancy under 9.0 percent. Available space remains limited, as only two submarkets have more than 5 million square feet of vacant space, Chicago South (5.9 msf) and I-80/Joliet Corridor (5.3 msf).

- Industrial space demand remains a catalyst for development in the Chicago market. Over 9.7 million square feet of new space completed construction in the third quarter, including three I-80/Joliet Corridor submarket developments totaling almost 3.2 million square feet.

Suburban and Downtown Office Markets Show Signs of Stabilization

Chicago’s suburban office market saw modest gains during the third quarter, with 13,672 square feet of positive net absorption. Leasing activity cooled following a strong first half of the year, with 1.4 million square feet of new space leased. Vacancy continues to stabilize, down 50 basis points from the end of 2021 to 24.5% during the third quarter.

- The East/West Corridor continues to pace the market with 501,290 square feet of new leasing activity during the third quarter, highlighted by Pivotal Corporation taking 100,000 square feet at 1415 W. Diehl Road in Naperville.

- The suburban market saw leasing activity moderate during the third quarter, with 1.4 million square feet of new leasing activity, down 38.5% quarter-over-quarter and down 18.6% year-over-year. Despite the moderate pullback, year-to-date leasing activity remains well ahead of 2021, up 23.8% to 5.4 million square feet through the third quarter.

- Overall vacancy tightened during the third quarter, down 40 basis points to 25.4%. While overall vacancy remains elevated compared to pre-pandemic levels, accelerated leasing activity from the first half of the year is likely to drive occupancy up as tenants begin to occupy new space.

Chicago’s CBD office market saw modest occupancy losses during the third quarter, with negative 15,009 square feet of net absorption, bringing year-to-date absorption to a negative 1.1 million square feet. While the downtown market has only seen one quarter of positive absorption dating back to the first quarter of 2021, the third quarter total represents a significant improvement from the 250,221 square feet of negative absorption during the second quarter, and the 1.3 million square feet of negative absorption during third quarter 2021.

- The downtown market registered 1.9 million square feet of new leasing activity during the third quarter, right in line with pandemic norms, which has averaged 2.0 million square feet since the first quarter of 2020.

- Overall vacancy remained unchanged at 19.5 percent the third quarter. Year-over-year, vacancy has risen 170 basis points from 17.8 percent during third quarter 2021 as a major halt in leasing activity during the second half of 2020 began to truly impact the market.

- There is 2.2 million square feet of office space currently under construction in the CBD, with the largest development headlined by Salesforce Tower in the River North Submarket. The 1.2 million-square-foot trophy building is fully leased by Salesforce and Kirkland & Ellis, and will add significant positive absorption upon completion during the first quarter of 2023.

Contact Us

Nick Schlanger

Research Director

630-691-0600

nschlanger@hiffman.com