February 2025

Hiffman Releases Q4 2024 Construction Pipeline Report

NAI Hiffman is pleased to present the Q4 2024 Construction Pipeline Report for industrial development in the Chicagoland market.

Shift from Spec Dominance to Build-To-Suit Developments

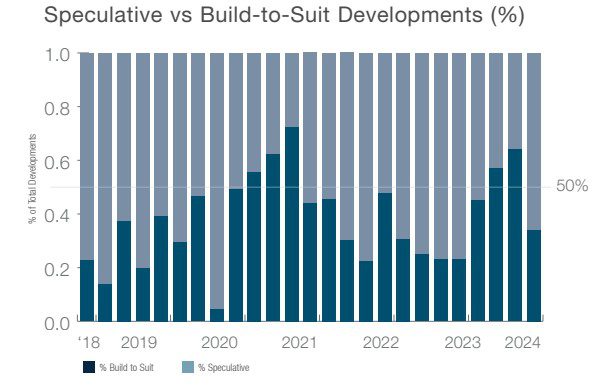

- The shift from speculative dominance in construction to build-to-suit developments, which occurred in mid-2024, continued to find momentum during the fourth quarter of 2024.

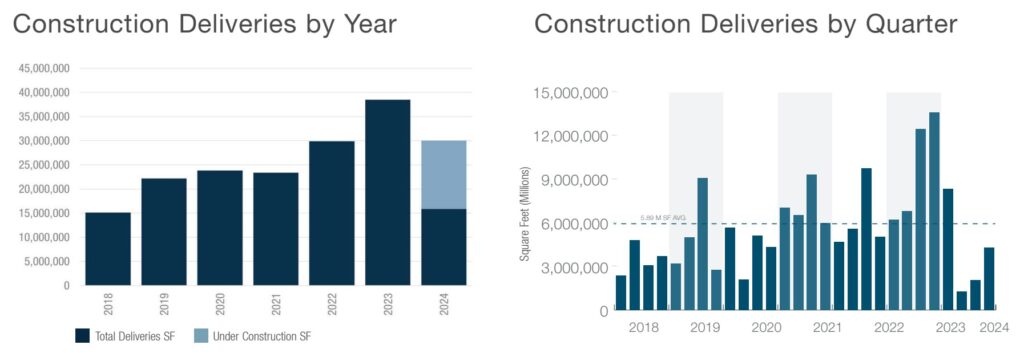

- One year ago, developers displayed much more confidence in the Chicago market. A total of 12.7 million square feet accounted for speculative construction projects – 77% of the 16.5 million square feet under construction at the end of 2023 – while build-to-suit projects represented 3.8 million square feet, or 23%.

- Just one year later, a drastic difference has come to light. Out of 14.1 million square feet under construction, 9.9 million square feet comprised of build-to-suit buildings or 69.8% of all square feet under construction. Speculative projects make up just 30.2% or 4.3 million square feet of all industrial developments. This result largely stems from the moderation in tenant demand, down from the heights seen during the years just following the Pandemic. With demand having settled back down to pre-pandemic levels, developers now prefer to have a committed tenant before breaking ground on new developments.

- Demand for first-generation industrial space built in 2022, 2023, and 2024 softened in the fourth quarter. Since early 2022, leasing activity for first-generation buildings averaged 3.3 million square feet per quarter. In the fourth quarter of 2024, 1.5 million square feet of new space were leased or pre-leased, a slight decline from 1.8 million square feet in the previous quarter.

Speculative vs. Build-to-Suit

The pandemic-induced economic shock in 2020 significantly shifted consumer spending toward online retailers, sparking a surge in demand for new distribution space. Developers responded enthusiastically, fueled by historically low interest rates, leading to a boom in speculative construction projects. However, as supply caught up with demand and inflationary pressures emerged – exacerbated by events like the war in Ukraine – consumer savings from pandemic stimulus measures dwindled. In response, the Federal Reserve raised interest rates, reducing confidence in the industrial real estate sector, particularly for e-commerce-focused developments.

The impact is evident in construction activity. In the fourth quarter of 2024, only six new projects broke ground, bringing the yearly total to 38 – significantly down from the peak of 86 construction starts in 2022. The market has shifted decisively toward build-to-suit facilities, moving away from the speculative dominance of recent years. A notable example is CJ Logistics’ 1.1 million square-foot build-to-suit project on South Diagonal Road in Elwood, which broke ground in the fourth quarter and is expected to be completed in the first half of 2026.

Build-to-suit projects now dominate the market, accounting for 9.9 million square feet under construction, compared to 4.3 million square feet of speculative space. Of the 42 buildings currently under construction, 22 are build-to-suit, and 20 are speculative. Speculative projects tend to be smaller, with four buildings under construction exceeding 1.0 million square feet – all of which are build-to-suit developments. This shift highlights developers’ growing preference for committed tenants before starting large-scale projects.

More information including complete submarket reports and notable projects under construction are available in the full Q4 2024 Construction Pipeline Report; click here to access the download.

Contact Us

Dan Worden

Research Analyst

630-398-8932

dworden@hiffman.com

About NAI Hiffman:

NAI Hiffman is one of the largest independent commercial real estate services firms in the US, with a primary focus on metropolitan Chicago, and part of the NAI Global network. We provide institutional and private leasing, property management, tenant representation, capital markets, project services, research, and marketing services for owners and occupiers of commercial real estate. To meet our clients’ growing needs outside of our exclusive NAI Hiffman territory, we launched Hiffman National, our dedicated property solutions division, which provides property management, project services, and property accounting services across the country. NAI Hiffman | Hiffman National is an award winning company headquartered in suburban Chicago, with more than 250 employees strategically located throughout North America.

About Hiffman National:

Hiffman National is one of the US’s largest independent commercial real estate property management and advisory firms, providing institutional and private clients exceptional customized solutions for property management, facility management, advisory services, accounting, lease administration, lender services, project management, marketing, and research. The firm’s comprehensive property management platform and attentive approach to service contribute to successful life-long relationships and client satisfaction. As a nationally bestowed Top Workplace, and recognized CRE award winner, Hiffman National is headquartered in suburban Chicago, with more than 250 employees nationally and an additional four hub locations and 15 satellite offices across North America.