October 2020

Third Quarter 2020 Market Peek

NAI Hiffman is pleased to present the Third Quarter 2020 Market Peek, a first look at the market statistics for the Chicago metropolitan office and industrial real estate markets.

Industrial: Despite Challenges, Industrial Market Maintains Positive Momentum

Chicago industrial in the third quarter of 2020 continued its impressive run of positive performance despite the continued uncertainty surrounding both the public health and the economy. The third quarter’s overall vacancy rate was 5.47 percent, actually tightening 16 basis points from third quarter 2019’s 5.63 percent. Four submarkets – Southwest Cook, Northwest Indiana, South Cook, and North Cook – each saw their respective vacancy rates dip below 4.0 percent on the quarter. The comparative submarket laggards – I-88 Corridor, I-90 Northwest, I-55 Corridor, and McHenry County – each have respective vacancy rates in the 7.0 percent range, demonstrating the overall strength of the industrial asset type in Chicagoland.

Continuing a positive absorption streak dating back to the third quarter of 2010, Chicago industrial had its best net absorption figure of the year in the third quarter, with over 4.0 million square feet of move-ins. The cumulative net absorption figure through the third quarter is 8.7 million square feet. While absorption remains positive, the third quarter 2020 figure trails its complementary 2019 figure by 14.5 percent. The I-80/Joliet Corridor led the way amongst its submarket peers with nearly 1.3 million square feet of net absorption. The I-88 Corridor submarket also had a strong 1.2 million square feet net absorption figure in the third quarter. On the year, the I-80/Joliet Corridor, West Cook, Southeast Wisconsin, and Southwest Cook are the four leading submarkets for absorption, each with more than 1.2 million square feet.

There was over 9.4 million square feet of new leasing activity in the third quarter. While this breaks a four consecutive quarter streak of leasing activity surpassing 10 million square feet, cumulative industrial leasing activity in 2020 is up 8.0 percent overall compared to the first three quarters of 2019. Spurred by the 1.0 million square feet General Motors lease at the Core5 Logistics Center in Joliet, the I-80/Joliet Corridor submarket led the way with 2.0 million square feet of new leasing activity. In contrast, the O’Hare submarket doubled its second-quarter amount, coming in at nearly 1.3 million square feet.

Nearly 5.1 million square feet of new supply delivered in the third quarter. There has been nearly 12.9 million square feet of new supply on the year, which is down 25.0 percent from last year in comparison. Leading the way, both the I-55 Corridor and O’Hare submarkets were recipients of over 1.0 million square feet of new supply on the quarter. There remained 25.6 million square feet under construction at quarter’s end, of which nearly 6.4 million square feet commenced in Q3.

Office: Absorption Turns Negative in the Third Quarter as Market Grapples with Uncertainty

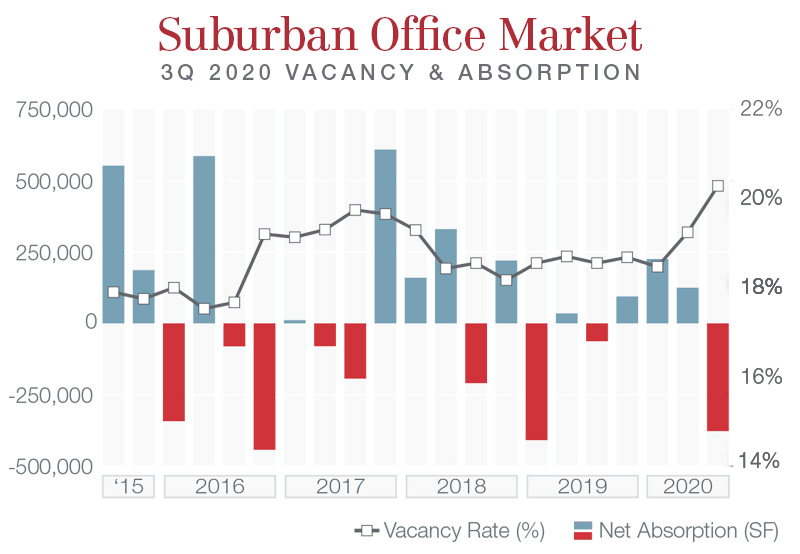

Suburbs

Due in large part to the continued uncertainty surrounding the Covid-19 pandemic, the suburban Chicago office market recorded over -375,000 square feet of absorption in the third quarter of 2020, snapping a three-quarter streak of positive absorption and wiping out the cumulative +239,664 square feet absorption figure recorded at mid-year. The news was not all negative, though, as the North Suburban submarket recorded over 140,000 square feet of positive absorption on the quarter, driven primarily by the Medline and Valent BioSciences move-ins at Innovation Park in Libertyville. Additionally, three of the five suburban submarkets – North Suburban, O’Hare, and I-55 Corridor – have positive, if modest, absorption through the first nine months of 2020.

As companies across the metro continue to grapple with their space needs, the office market’s sublease portion warrants continued scrutiny. The sublet vacant portion of the Class A suburban office market has increased 5.2 percent year-over-year, from the 755,061 square feet recorded in the third quarter of 2019 to the 794,387 square feet recorded in the third quarter of 2020. The overall rate inched up ten basis points to 0.78 percent of the market. The total suburban vacancy rate in the third quarter came in at 20.28 percent, softening 173 basis points from the 18.55 percent recorded in the third quarter of 2019. This rate has the potential to inch up further by year’s end, with more sublet space becoming available.

There was nearly 1.1 million square feet of leasing activity in the suburban Chicago office market in the third quarter. This figure picked up 12.0 percent compared to the previous quarter, while remaining nearly a third off leasing activity in the third quarter of 2019. With over 460,000 square feet, the East-West Corridor led all its peer submarkets in leasing activity on the quarter, with the Northwest Suburban submarket coming in a strong second place with just over 300,000 square feet.

Notable leasing activity on the quarter includes:

- Ajinomoto North America – leasing 58,301 square feet at 250 East Devon Ave. in Itasca.

- Newly Weds Foods – leasing 44,511 square feet at 8550 West Bryn Mawr Ave. in the O’Hare submarket.

- Water Quality Association – leasing 37,259 square feet at 2375 Cabot Drive in Lisle.

While the suburban Chicago office market experienced expected adversity in the third quarter due to Covid-19, it is positioned as a viable alternative to a dense downtown market that was already facing a glut of new supply at the start of 2020 from several high-profile deliveries throughout the year.

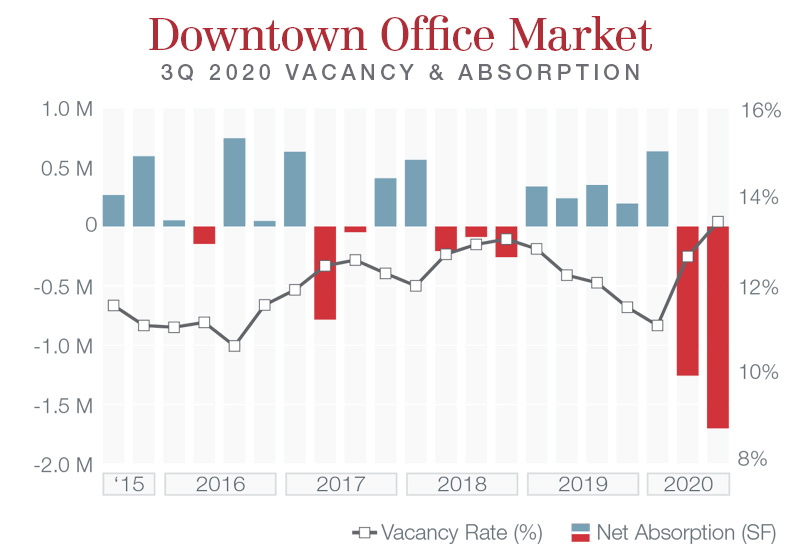

CBD

With the delivery of the 55-story, 1.5-million-square-foot Bank of America Tower the downtown Chicago office market faced more difficulty in the third quarter of 2020 as total net absorption downtown was recorded at -1.7 million square feet. While the skyscraper’s nearly 80.0 percent pre-leasing figure will go a long way towards positive absorption figures in upcoming quarters for the West Loop submarket, no immediate boon is expected for the Central Loop, North Michigan Ave, or River North submarkets, which each experienced declines of absorption ranging from -79,000 square feet (River North) to -131,000 square feet (Central Loop). The East Loop was the one bright spot with respect to absorption, as Northern Trust moved into over 400,000 square feet at the recently renovated 333 S Wabash Ave, affectionately known as Big Red.

Unlike the sublease market in the suburban office space, which experienced comparatively modest increases since the onset of Covid-19, the downtown office sublease arena is grappling with a massive influx of space coming to the market. The third quarter of 2020 saw nearly 1.89 million square feet of vacant sublet space on the market, a 12.0 percent increase from the previous quarter figure of 1.68 million square feet. The 60.7 percent increase on sublease space compared to the third quarter of 2019’s 1.17 million square foot figure is far more worrisome for the short-term in a market that had seen successive quarters of trophy-to-Class-A deliveries in excess of 2.1 million square feet, independent of a heightened pace of deliveries throughout the West Loop’s Fulton Market neighborhood.

Additionally, the nearly 450,000 square feet of leasing activity in the downtown office market paled in comparison to the suburban figure of nearly 1.1 million square feet. While renewals and extensions were prevalent in the quarter’s activity, there were a handful of new leases signed on the quarter, highlighted by a couple of new deals at 500 West Monroe St in the West Loop:

- Motorola Solutions expanding their space by 26,732 square feet

- Adtalem Global Education expanding their space by 57,110 square feet on a sublease

Overall, the downtown office market was already at the mercy of expected availabilities in 2020 from a newly-renovated 24 East Washington (652,452 square feet), and Bank of America Tower (1,546,909 square feet); with another 1.6 million square feet delivering throughout the year in Fulton Market spread across five properties, highlighted by 167 North Green Street’s expected completion in the fourth quarter of 2020. With the added Covid-19 uncertainty creating further continued pressure on the downtown office market, deliveries, subleases, renewals, and extensions seem poised to dominate the space more than ever over pure new leasing activity.

Contact Us

For further information regarding the content of this market peek, please contact:

Mike Morrone

Research Director

630-693-0645

mmorrone@hiffman.com