January 2021

Year-End 2020 Market Peek

NAI Hiffman is pleased to present the Year-End 2020 Market Peek, a first look at the market statistics for the Chicago metropolitan office and industrial real estate markets.

Industrial: Strong Fourth Quarter Completes Resilient Year

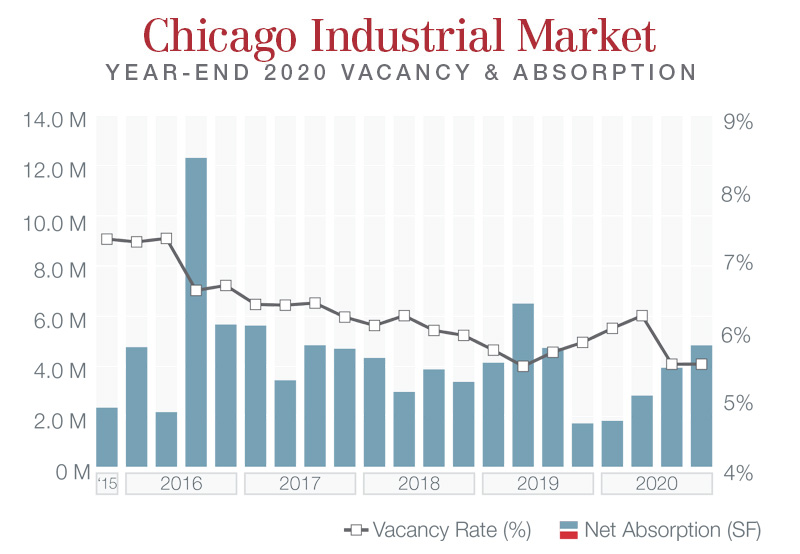

Chicago industrial maintained momentum at the end of 2020 despite the ongoing Covid-19 pandemic. The overall vacancy rate at year end was 5.46 percent. While this rate remained unchanged from the previous quarter, it decreased 33 basis points year-over-year compared to the 5.79 percent vacancy rate from the fourth quarter of 2019. To put these numbers in context, despite 4.3 million square feet of new supply being delivered in the fourth quarter, the vacancy rate remained flat; and notwithstanding the fact that 17.2 million square feet of new supply delivered to the Chicago metro throughout the course of 2020, the vacancy rate still fell by 1/3 of a point. It further demonstrates that the supply of new product very closely mimicked the demand over these past 12 months.

On a more granular basis, the Southwest Cook submarket recorded a 1.48 percent vacancy rate at year-end, leading its peer submarkets in the Chicago metro. An additional six submarkets – Northwest Indiana, South Cook, Southeast Wisconsin, North Cook, I-80/Joliet Corridor, and Chicago South – recorded vacancy rates between 3.5 percent and 4.0 percent at year-end. Among the 21 submarkets tracked, only the I-55 Corridor recorded a double-digit vacancy rate to end 2020.

Net absorption steadily increased throughout the year while ending 2020 on a high note, as over 4.8 million square feet of move-ins were recorded in the fourth quarter. The I-80/Joliet Corridor led all submarkets in net absorption, its 1.7 million square feet of move-ins more than doubled the net absorption figures of both the O’Hare (second-ranked) and South Cook (third-ranked) submarkets, which each recorded approximately 825,000 square feet of move-ins. The I-80/Joliet Corridor racked up more than a million square feet of net absorption in each quarter of 2020, ending 2020 with more than 5.1 million square feet of move-ins. An additional five submarkets were also quite active – West Cook, Southeast Wisconsin, Southwest Cook, I-88 Corridor, and South Cook – as each recorded between 1.0 million square feet and 2.5 million square feet of cumulative net absorption in 2020. Overall, the Chicago metro recorded 13.4 million square feet of net absorption in 2020. While this figure is certainly impressive considering the uncertainty brought about by the pandemic, the full-year figure declined by 17.8 percent as compared to the nearly 16.4 million square feet of net absorption recorded in 2019.

There was nearly 15.0 million square feet of new leasing activity to close 2020. This represented a 41.2 percent increase year-over-year compared to the nearly 10.6 million square feet of new leasing activity recorded during the same period last year. Overall new leasing activity in 2020 was an eye-opening 48.4 million square feet. Over the final 3 months, the I-80/Joliet Corridor led the way again amongst its peer submarkets with nearly 4.9 million square feet of leasing activity. Respective deals for more than a million square feet signed by CJ Logistics and Scotts Miracle-Gro at Crossroads 55 in Channahon accounted for 47.2 percent of this new leasing activity on the quarter. An additional three submarkets – O’Hare, Chicago South, and South Cook – each recorded between 1.0 million square feet and 1.8 million square feet of new leasing activity to end 2020.

Among the fourth quarter deliveries, I-55 Corridor led the way with over 1.6 million square feet of new product completions across three facilities, while the I-80/Joliet Corridor filled out its impressive stats sheet with two deliveries totaling nearly 1.2 million square feet. An additional 25.6 million square feet of developments remain under construction at the end of 2020. Based upon these metrics, it is clear that the industrial market was the darling of Chicago commercial real estate during an especially uncertain 2020.

Office: COVID Fallout Batters Downtown & Suburban Office Markets

Suburbs

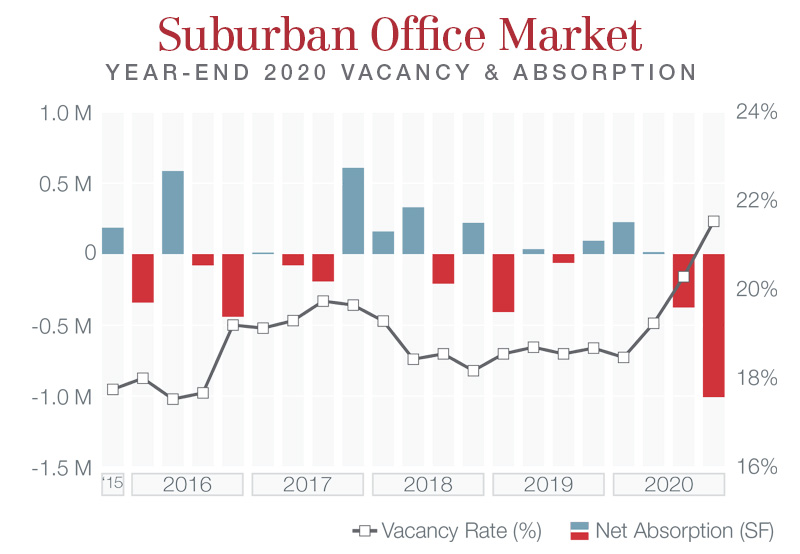

The suburban Chicago office market wrapped up 2020 with a 21.54 percent total vacancy rate. This rate increased 286 basis points year-over-year. The sublease vacancy rate was 1.47 percent, increasing 77 basis points year-over-year. Several notable spaces were brought to the sublease market in the fourth quarter, including:

- Capital One’s 165,000 square feet at Atrium Corporate Center in Rolling Meadows in the Northwest Suburban submarket

- Adtalem Global Education’s 162,000 square feet at Highland Landmark V in Downers Grove in the East-West Corridor

- Middough’s 47,000 square feet at Oak Brook Pointe in the East-West Corridor

Partly due to these space additions, there was -1.0 million square feet of net absorption recorded in the fourth quarter. While every submarket gave back space during this time, the O’Hare and I-55 Corridor submarkets each recorded positive, if modest, net absorption figures in 2020 as a whole. O’Hare’s 10,772 square feet of net absorption led all submarkets in 2020, surprisingly outpacing the submarket’s 2019 full-year net absorption of -69,186 square feet.

The suburban Chicago office market recorded 1,192,348 square feet of new leasing activity in the fourth quarter, declining only 4.5 percent year-over-year from its performance in fourth quarter of 2019. Of significant note, this is the second consecutive quarter in which suburban new leasing activity outpaced downtown. In aggregate, suburban Chicago’s fourth quarter leasing represented 71.4 percent of total new leasing activity in the Chicago metro’s office markets, with downtown accounting for the remaining 28.6 percent. The East-West Corridor led the way with 436,677 square feet of new leasing activity on the quarter, while the North Suburban submarket placed a strong second overall with 354,973 square feet – a 31.2 percent year-over-year increase compared to the same period last year.

Unlike downtown, whose largest transaction on the quarter was a renewal, the largest deal recorded in suburban Chicago was the 72,750 square feet that Stepan subleased at Corporate Center I in Northbrook in the Northern Suburban submarket. Additionally, notable direct leases signed in the fourth quarter in the East-West Corridor include:

- Citgo signing for 42,365 square feet at Corridors One in Downers Grove

- Kellogg leasing 30,414 square feet at The Shuman in Naperville

While the suburban Chicago office market was not impervious to the professional hardships induced by the Covid-19 pandemic in 2020, there were scattered rays of proverbial sunshine. As the pandemic hopefully subsides from a wave of vaccinations in the coming months, we believe executives and their businesses will look to shift from the primarily reactive strategies of 2020 to a more proactive approach in 2021. These decisionmakers will have myriad options available in an environment where, as Crain’s Chicago Business recently reported, suburban home sales were up 18 percent in 2020 compared to 2019. This residential migration is likely to portend a similar consideration by employers looking to create outlying work environments for their newly-minted suburban employees.

CBD

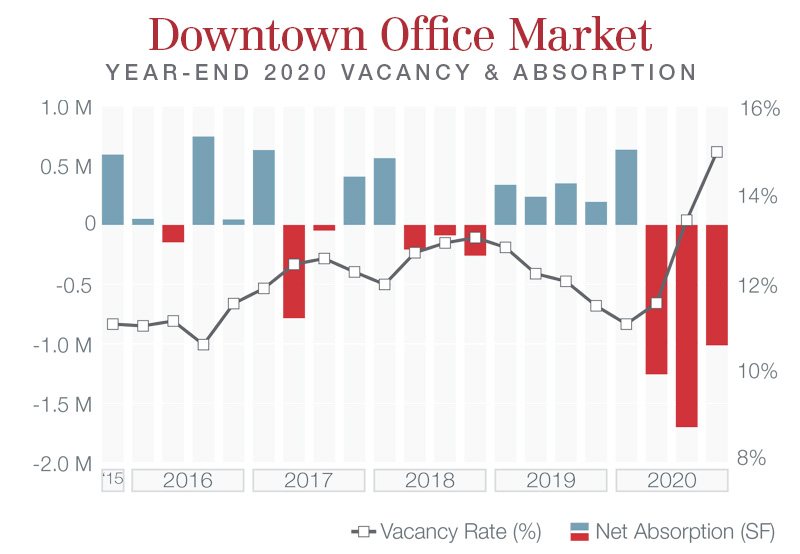

Deliveries, sublet spaces, and renewals defined Chicago’s downtown office market throughout 2020, and the fourth quarter was no exception. Three developments delivered in the West Loop’s Fulton Market neighborhood in the fourth quarter, bringing 837,493 more square feet to a submarket which had just added the 1.5-million-square-foot Bank of America Tower in the closing days of the third quarter. Unlike Bank of America Tower (which was nearly 80.0 percent pre-leased at completion), the Fulton Market projects were primarily speculative developments. With an additional 4.2 million square feet of development currently under construction downtown at year-end, the office market will have its work cut out for it to approach the peak performances of 2019.

The downtown Chicago office market closed 2020 with a 14.97 percent total vacancy rate. This rate increased 345 basis points year-over-year. The sublease vacancy rate was 1.75 percent, increasing 88 basis points year-over-year. Sublet vacant space on the market downtown doubled year-over-year to nearly 2.7 million square feet. Notably, vacant sublet space in the West Loop increased 161.9 percent year-over-year, as over 800,000 square feet of new space came to market over the course of 2020 in that submarket alone. Overall, nearly 1.3 million square feet of sublet vacant space was on the market in the West Loop alone at year-end.

There was another -1.0 million square feet of net absorption in the fourth quarter downtown, the third consecutive quarter with net absorption of more than -1.0 million square feet. The Class A portion of the West Loop submarket was the peak performer amongst its peers, as Bank of America moved into its namesake tower at 110 N Wacker Dr at the start of the quarter. While the West Loop will be well-positioned post-pandemic with several high-end developments, there are no easy answers in the offing for the Central Loop. The submarket, which has seen myriad tenants depart the cavernous feel of its well-established stock in recent years for the light and air of riverside inventory primarily found in the West Loop, gave back 1.26 million square feet of space to the market over the course of 2020. This accounts for 38.4 percent of downtown office’s cumulative 2020 negative absorption figure.

There was 477,895 square feet of new leasing activity downtown to close out 2020. This represented a 78.7 percent decrease year-over-year. Full-year new leasing activity came in at nearly 4.8 million square feet, but only 20.3 percent of that figure came from the second half of 2020. The largest deal on the quarter does not factor into the figures though, as the GSA renewed nearly 176,000 square feet at Two Illinois Center in the East Loop. Additionally, coworking firm Industrious signed for 52,000 square feet of space at Willis Tower in the West Loop. The largest traditional office deal was the 25,569 square feet that Primera Engineers signed for at 550 W Jackson Blvd in the West Loop. Compared to the rest of 2020, this was the smallest deal to take the pole position for a single quarter on the year.

As the vaccines for Covid-19 trickle from the elderly, front-line workers, and high-risk individuals at the tail-end of 2020 to the general population over the course of 2021, the downtown office market will have the potential to begin recovering in earnest. It remains to be seen what a post-pandemic office market will look like though compared to a market in an early 2020 setting where density, bench-style seating, and mass transit options were essential and positive elements of a strong market.

Contact Us

For further information regarding the content of this market peek, please contact:

Mike Morrone

Research Director

630-693-0645

mmorrone@hiffman.com