July 2020

Second Quarter 2020 Market Peek

NAI Hiffman is pleased to present the Second Quarter 2020 Market Peek, a first look at the market statistics for the Chicago metropolitan office and industrial real estate markets.

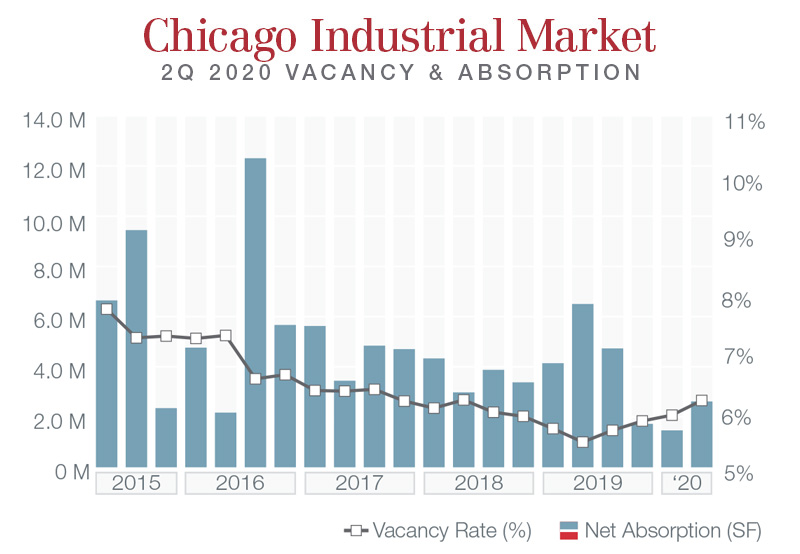

Industrial: Resilient Industrial Market Maintains Momentum

In the first full quarter of the Covid-19 pandemic dominating all facets of life, Chicago industrial kept up its end of the commercial real estate spectrum. Nearly 3.0 M SF of new supply delivered across 12 properties in the second quarter, highlighted by a nearly 359,000 SF building on the site of the former Republic Steel factory in the Chicago South submarket that Ford will occupy in late 2020. The shovel hit the dirt on another nine projects covering over 4.0 M SF of new construction activity, concentrated in the South Cook (1.2 M SF) and Southeast Wisconsin (1.0 M SF) submarkets. The construction pipeline remains robust, with nearly 21.0 M SF underway.

New product delivery contributed to the collective vacancy rate inching up 19 basis points from the first quarter to 6.14%. Despite the overall increase, several submarkets tightened compared to first-quarter numbers, led by DeKalb County (4.15%), North Cook (4.36%), and Southwest Cook (3.40%).

Leasing activity increased 1.0 M SF compared to the first quarter, with nearly 12.5 M SF of deals recorded in the second quarter. Amazon dominated the list of top second-quarter deals, signing five of the top eight leases and topped off by a 3.5 M SF distribution center in Markham, Illinois. The South Cook, I-80/Joliet Corridor, and Chicago South submarkets each tallied over 1.0 M SF of leasing activity in the quarter.

Chicago industrial’s second quarter included over 2.6 M SF of move-ins, demonstrating that despite shelter-in-place orders and large-scale changes to day-to-day life that would have been unthinkable six months ago, demand has not evaporated.

Office: Suburbs Weather Covid-19 Impact; Downtown Faces Continued Uncertainty

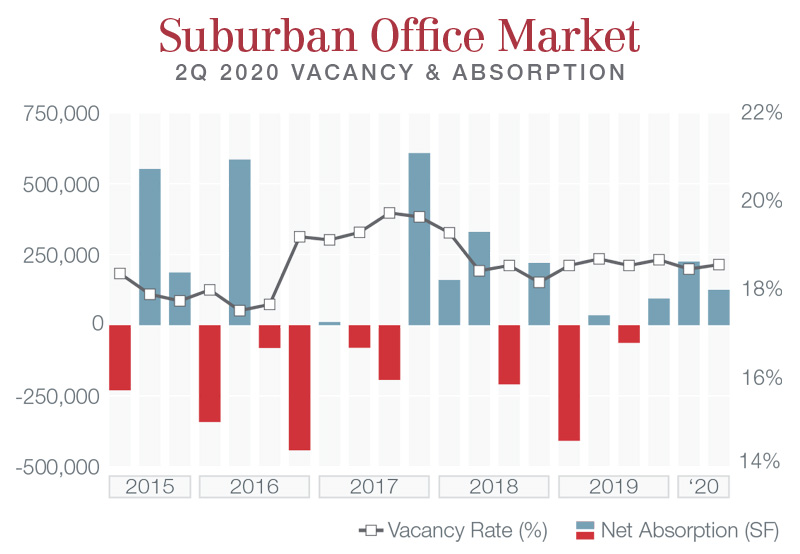

Suburbs

The suburban Chicago office market saw its vacancy rise to 19.24% in the second quarter of 2020, a 54-basis point year-over-year increase. While some adversity was to be expected in an environment where pandemic-driven shelter-in-place orders forcibly kept large portions of office-using employees from actually going to the office, this reality was not reflected by subleases in the second quarter. The sublease vacancy rate was 0.68% on the quarter (820,039 SF), a year-over-year decline compared to Q2 2019’s 0.73% sublease vacancy rate (955,036 SF).

Absorption in the second quarter declined from the start of the year, yet remained positive at 125,206 SF. The O’Hare submarket was the leader among its peers, seeing 175,444 SF of move-ins on the quarter. Comparatively, the East-West Corridor was the laggard at -47,239 SF. Despite this hiccup for the East-West Corridor, absorption remained positive, if modest on the year (6,736 SF).

Overall leasing activity persevered in the suburbs despite the difficult environment, as over 940,000 SF of activity occurred in the second quarter. The East-West Corridor is poised to gain absorption at an outsized rate compared to its peers in the second half of 2020, as several notable leases signed in the submarket, namely:

- American Board of Radiology (71,183 SF) at 814 Commerce Drive in Oak Brook,

- XPO Logistics (50,663 SF) at The Shuman in Naperville, and

- LTF (40,091 SF), also at The Shuman.

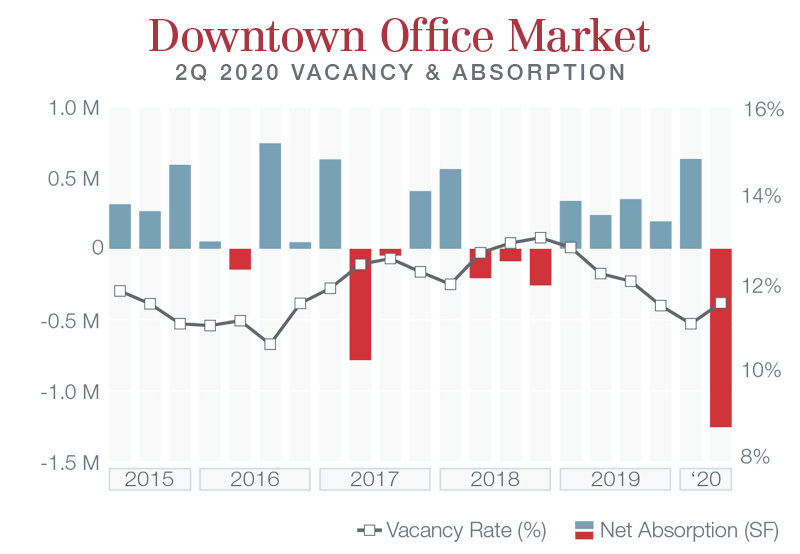

Unsurprisingly, the Downtown Chicago office market momentum stalled in the second quarter due to the Covid-19 pandemic. Total vacancy increased 41 basis points year-over-year to a still-respectable 12.65%. The North Michigan Avenue submarket led its peers with a 9.69% vacancy, while the East Loop experienced a notable, if unique, jump to 17.93%. The East Loop’s absorption was significantly and adversely affected on the quarter in both Class A space (The Marshall Fields office redevelopment at 24 East Washington Street delivered) and Class B (Robert Morris University moved out of 355,000 SF at 401 South State Street). These two events resulted in the submarket recording over 1.1 M SF of negative absorption on the quarter, ultimately contributing to the 1.3 M SF of overall negative absorption in the downtown market for the second quarter.

The environment wasn’t completely negative though, as the CBD recorded nearly 1.1 M SF of new leasing activity on the quarter. Notable new leasing activity on the quarter was spread throughout the downtown market, including:

- CCC Information Systems signed 133,749 SF at 167 N Green St,

- Old Mission Capital leasing 38,000 SF at 1 North Dearborn Street in the Central Loop, and

- PHD Media leasing 33,000 SF at the Aon Center in the East Loop.

Contact Us

Mike Morrone

Research Director

630-693-0645

mmorrone@hiffman.com